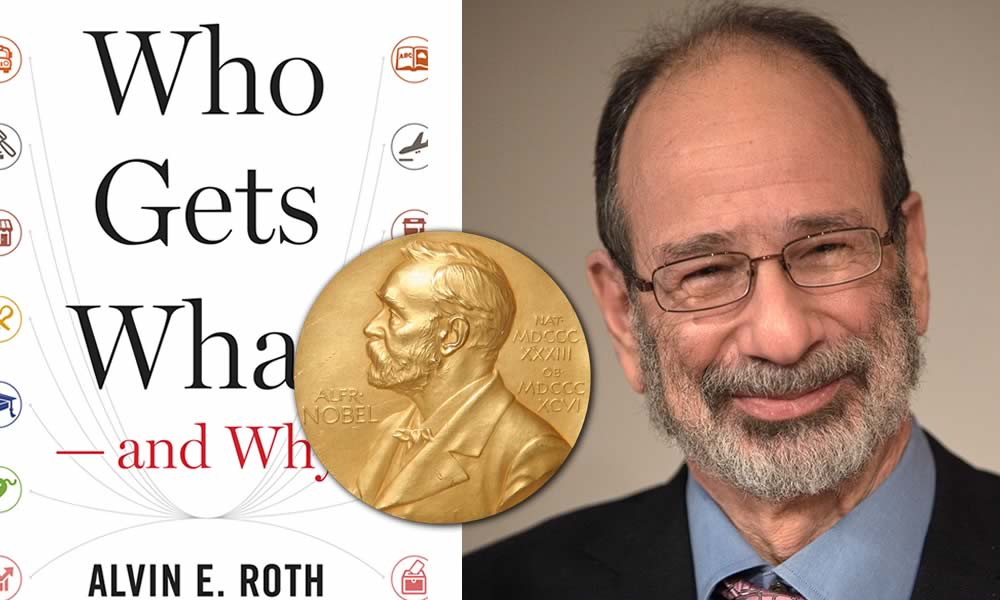

My guest today on The Brainfluence Podcast is quite a unique scholar. Al Roth is the Craig and Susan McCaw Professor of Economics at Stanford University, as well as the Gund Professor of Economics and Business Administration Emeritus at Harvard University. He is the author of Who Gets What And Why: The New Economics of Matchmaking and Market Design. He also happens to have been awarded the Nobel Prize for Economics in 2012.

My guest today on The Brainfluence Podcast is quite a unique scholar. Al Roth is the Craig and Susan McCaw Professor of Economics at Stanford University, as well as the Gund Professor of Economics and Business Administration Emeritus at Harvard University. He is the author of Who Gets What And Why: The New Economics of Matchmaking and Market Design. He also happens to have been awarded the Nobel Prize for Economics in 2012.

While winning a Nobel Prize makes Al unique, what sets him apart is his application of his knowledge of economics in solving seemingly intractable real-world problems. His insights have resulted in market creation in areas like city-wide school admissions, hospital internship negotiations, and kidney transplants that save thousands of lives each year.

Today, we’re going to hear how an economics professor turned into a lifesaver and how you can apply some of Al’s insights to your business ventures. The principles that Al has brought to the medical field, and that have been used in some of the great entrepreneurial successes in recent history, are readily accessible to you. These same principles can be used to understand and identify novel business opportunities, reshape the way you view your business and help you experience incredible success.

If you enjoy the show, please drop by iTunes and leave a review while you are still feeling the love! Reviews help others discover this podcast, and I greatly appreciate them!

Listen in:

Podcast: Play in new window | Download

On Today’s Episode We’ll Learn:

- How matching markets work.

- The markets where prices don’t do all of the work.

- The two types of signals that people send.

- How to use Al’s methods to experience success with online dating.

- How economics is being applied to reduce kidney transplant wait lists.

Key Resources:

- Amazon: Who Gets What And Why: The New Economics of Matchmaking and Market Design by Al Roth

- Kindle: Who Gets What And Why: The New Economics of Matchmaking and Market Design by Al Roth

- Connect with Al: Market Design Blog | Google+

- Daniel Kahneman

- Ronald Coase

- Itai Ashlagi

- Donate Life California

- AirBnB

Share the Love:

If you like The Brainfluence Podcast…

Never miss an episode by subscribing via iTunes, Stitcher or by RSS

Help improve the show by Leaving a Rating & Review in iTunes (Here’s How)

Join the discussion for this episode in the comments section below

Full Episode Transcript:

Welcome to the Brainfluence Podcast with Roger Dooley, author, speaker and educator on neuromarketing and the psychology of persuasion. Every week, we talk with thought leaders that will help you improve your influence with factual evidence and concrete research. Introducing your host, Roger Dooley.

Roger Dooley: Welcome to the Brainfluence Podcast. I’m Roger Dooley and today’s guest as perhaps the most impressive resume and this time, this podcast but not just part of any podcast that you’ll hear in the next week or two or three. He’s a professor at Stanford and professor emeritus at Harvard, both name shares. He won a Nobel Prize for economics in 2012. That’s an amazing accomplishment but to me, the reasons for his win are even more amazing.

Most academics operate in the world of theory. That’s particularly true in economics or critics say things like, “If you wait all the economists and you never reach conclusion.” Today’s guest took his Nobel economic theory and applied it in the real world. If that’s not enough, he did it in a way that now saves thousands of lives each year. People call economics the dismal science state, clearly don’t know today’s guest. Today, we’re going to hear how an economics professor turned into a lifesaver and how you can apply some of the same insights in your own business ventures, same principles that you brought to bear medical field underlies some of the great entrepreneurial successes in recent history. Welcome to the show, Al Roth.

Al Roth: Thank you.

Roger Dooley: Al, it’s amazing to have you on the show. I need to start with a confession. In the last year so, I’ve started some of my speeches with a Nobel Prize story. I explained to the audience that they might not know it but in 2014, I was invited to Stockholm. As I was climbing the steps to the stage where they wore the Nobel prizes, I got a little shaky but then I get a good laugh when I explained right away that I was just there and speaking of digital marketing conference. I’d used that as a read into and introduce the work of a couple of real Nobelist like Daniel Kahneman or Ronald Coase and I guess now I have added some Al Roth too.

Al Roth: I remember that today, just an exciting place.

Roger Dooley: Actually, I was probably not on the same one. I was at the one where they awarded the original prizes which is like a historic music hall in downtown at Stockholm which is a beautiful facility but I don’t think that’s where they do it now. I’m not sure. Before we get into that content, I’ve heard stories that were related by other Nobel Prize winners who got the call from Stockholm and were too busy to answer the phone or thought it was a joke. Was there anything not worthy about your call?

Al Roth: Well, we were asleep so we missed it. My wife woke up and nudged me and said, “I think the phone is ringing.” It wasn’t ringing by then so I tried to go back to sleep. She went and got the phone and fortunately, they called back.

Roger Dooley: That’s great. I have to ask this. Do professors or students ever played practical jokes about placing phone calls at weird hours and speaking those Swedish accents? They ever call up anybody at University of Chicago for example?

Al Roth: I had never heard of any such joke but I believe that the people in Sweden who award the Nobel prize have heard that joke because when they call, one of the big things that seems to be on their mind is to persuade you that it’s not a joke. If that who called me initially was I guess the Chairman of the Committee or maybe the President of the Academy of Science, I’m not sure. What he said, “You’ve won the Nobel prize. I’m here with six of my colleagues. Two of whom you know and they will now speak to you.”

Roger Dooley: Okay, great. I hope I didn’t give anyone any ideas. At least you’re immune now. Let me start by saying that I’ve read your new book and for our audience, the title is ‘Who Gets What and Why? The new economics of matchmaking and market design.” It’s really a fascinating book Al and I find to be very readable. For our listeners who might be expecting a dense tone of economic theory and what would make extrapolations and that sort of thing, it is not that at all. It really shows how theory can be applied to solving real-world problems. What audience did you write the book for?

Al Roth: I wrote it for a general intelligent audience that’s interested in economics. I think of it a little as a field guide to market in the sense that … I own books that are field guide to flowers or field guide to birds. You look through the books and you see new things to look for when you’re out in the field looking at birds or flowers. What I’m trying to do is urge people to the different kinds of markets that they are in the world and how you can think about them differently once you learn to see how markets work.

Roger Dooley: Right, well maybe it had to be a good jumping off point. What you’re saying I think Al is that you see markets everywhere and sometimes, maybe where people may not have seen markets. What do you mean by a market? When you order a couple of examples maybe of markets that people might not think of as such.

Al Roth: Okay. I think that often when we think of markets, we think of commodity markets. Markets where you don’t care who you’re dealing with, you can deal at arm’s length and the only important thing is the price and it’s the job of the market to find the price at which supply equals demand. Many markets don’t work that way at all. I talk about matching markets as being markets in which you can’t just choose what you want, you also have to be chosen.

There are lots of matching markets starting obviously with labor markets, with job markets. You can’t just decide to go work for Google, you have to be hired. Google can’t just choose you, they have to compete with Facebook and other places that you might want to work. Of course labor markets are in markets in which prices are set so that supply equals demand. Google doesn’t lure its wages until just enough engineers want to come and work for them. They have high wages there, a desirable job, lots of people would like to come work for them and that’s why they have this complicated hiring process and you can’t just come work for them because you like the wage or you have to be hired and they can’t just hire you because they can afford you.

Of course college admission is like that too. I teach at Stanford. Stanford doesn’t admit an entering class by raising the tuition until just enough students want to come to fill the class or the dormitories. Lots of people would like to come to Stanford although it’s expensive and there’s a whole application and admissions process so you can’t just come to Stanford. You have to be admitted. Stanford can’t just decide that you’ll come. They have to compete with Harvard.

In that way, many markets have a lot in common more than we might think with courtship and marriage. You can’t just choose your spouse. You also have to be chosen. In many of these markets, I guess one of the points is that in many of these markets, prices don’t do all the work, right? In the New York stock exchange, the job of the exchange is to find from moment to moment the price that’ll make supply equals demand for each of the securities that are on sale. That’s not the case in all of these markets. They have other market institutions and so signals have to be sent and information has to be transmitted that isn’t simply contained in the price.

Roger Dooley: Right. You speak about signaling and that would be ways that each entity can show interest or show something themselves that will make them attractive to other party. Since it’s not a price-driven thing, people are looking forward with matches whereas schools are looking … Students who are … They press not just smart but also capable of accomplishing great things and students aren’t looking for the schools with the highest scores but they’re looking for a unique educational experience or even … It’s all the life experience and so on.

Al Roth: I think of it is there are two kinds of signals that people send. One kind of signal is, “I’m interesting. You should be interested in me.” When you’re applying to colleges, that’s the signal that says, “Look at my high school grades, I studied hard and I did well. I’ll be a good student in college. You should admit me.” There’s another kind of signal which says, “I’m interested in you.” You get many more applications for your college than you can admit and even then you can look at carefully.

One of the things you want to know in a congested market is which of these people who … If we pursued them, do we have a chance of having them come? That’s why one of the things I say in the book is if you know a high school senior who’s visiting colleges, you should tell him or her to sign the guest book in the admissions office because nowadays, with the internet and a common app, it’s quite easy to apply to many colleges. The mere fact of having submitted an application no longer conveys a great deal of information about how interested you are in that college. Coming to visit a college is a costly signal. It’s a signal that you can’t … It is easier to apply to a dozen colleges. It’s quite a bit harder to visit a dozen and it’s certainly hard to visit two dozen. A student who’s visited, that’s something that’s taken not of in the admissions decision of many colleges.

Again, it’s a little bit similar to courtship and marriage. Think about the internet dating market that proliferated now. Many of them are also congested. Women with attractive profiles get many more emails than they can answer or considered carefully. Men who are on this site too aren’t getting a lot of replies, might be tempted to send even more emails. That’s different than getting an email from someone who has looked carefully and is really interested.

I have some colleagues who have experimented on a dating site with giving people what they called two virtual verses. In this experiment, you can send as many emails as you like on either actual dating sites. You can only attach two verses a day. What they find is that messages that that come accompanied with verses lead to a lot more context than those that don’t. Signing the guest book when you visit a college camp, it’s just like sending a rose that says, “I can’t do this for every college that I might be able to apply to.”

Similarly when you’re applying for a job, sending a signal that you know that not just would you be good for the job, you’re an accomplished guy but also that you know something about this firm and you’ve looked into it and would be actually quite interested. It’s not just something that you decided you needed to send off three applications every day and this was one of them. Those things help in the job market. Again, it’s because prices don’t convey all the information.

Roger Dooley: Right. As I mentioned when I first communicated with you, I co-found the business called College Confidential which was a design to help students and parents learn more about the college process, largely through a community effort and crowdsourcing. There were a whole host of signals that students try and send from visiting, from following up with the original admissions office or by email, from perhaps contacting a particular professor that is in the area of most interest. The list goes on and on in different ways but folks trying so many signals which of course I’m sure can be overwhelming too on the school’s side of things. Everyone seen its special and everybody is reading the same stuff and trying to send those signals.

Let’s change gears a little bit and go over to organ transplants which again it’s one of those markets that most people would not necessarily think of as a market. I think traditionally, what we hear about are waiting list where somebody needs a transplant so they go on a waiting list and then just hope for the best that somebody will perhaps have a fatal accident which is sad for them but might make their organs available or perhaps a volunteer donor would donate an organ and jumped on list. Explain a little bit about the market process there and in particular, some of the work that you’ve done.

Al Roth: Let me start off by saying that organs for transplant are one of the markets in which we don’t allow prices to do any work. Not only don’t prices do all the work, it’s actually against the law in the United States and almost everywhere in the world to pay money for an organ for transplant. There’s one exception for that. There’s a legal cash market for kidneys in the Islamic Republic of Iran but everywhere else, it’s illegal although there are black markets.

The story about kidneys which is where I’ve worked is there are more than 100,000 people on the waiting list in the United States waiting for a deceased donor kidney. We only get about 11,000 deceased donor kidneys a year. It turns out it’s mostly when you die, you take the organs with you. You have to die in fairly special ways in order to be eligible to be a donor. The waiting list is long and dangerous. Thousands of people die every year while waiting.

One of the things that makes kidney special is that healthy people have two kidneys and can remain healthy with one. What that means is that if you love someone who has kidney disease and you’re healthy enough to give a kidney, you might be able to give a kidney to the person you love and save their life. Sometimes even though you’re healthy enough to give a kidney to the person you love, you can’t give that person your kidney because kidneys have to be matched to the patient. They have to be compatible in lots of medical and biological ways.

What used to happen is you would be sent home. You would go get your blood tested and they would say to you, “Sorry, it’s very noble of you to be willing to give a kidney but you can’t. Go home.” The person you love would be left on that years’ long perilous waiting list. Supposing, the same situation as you, that is, “I would like to give a kidney to someone I love but I can’t. I’m healthy enough to give a kidney to someone but my kidney doesn’t match the person I love.” Well then we can have a kidney exchanged and this is the market place that I’ve been involved in that you’ve been talking about and the kidney exchange, no money changes hands but I give a kidney to your patient and you give a kidney to my patient and both of the people we love get a compatible kidney and resume healthy living. That’s a very simple kind of exchange but it’s clearly the kind of thing that economist ought to get involved and helping organized because it’s an exchange through which people become better off.

My economist colleagues and I initially …, more recently, Itai Ashlagi, we worked with a lot of our surgical colleagues, initially Frank Delmonico or more recently, Mike Reese to organize these exchanges on a large scale. Kidney exchange has become a standard part of American transplantation and thousands of transplants have been done that wouldn’t have been done otherwise. It doesn’t solve the whole problem. There are still 100,000 people waiting for a deceased donor kidney but it makes a dent.

Roger Dooley: That’s great and I really congratulate you for your work on that. It’s wonderful too and not only create a theory but also to see it’s have such a positive impact in the world. One question while we’re still on the kidneys is I recall some years back to hearing a professor Dan, I don’t remember where he was but … Became at one area where some payment might be appropriate is for deceased donors who often have relatives or even doctors who ignore their invitation that would donate their organs and say, “No, we don’t want to do that.” Generally, the wishes of the relatives and her doctors might be honored even though the individual had clearly intended to donate organs. In these cases, it might be appropriate to provide some type of payment even to say, help with funeral expenses and so on at the time of need but also to facilitate those organs from simply not being discarded. What do you think about that?

Al Roth: That’s definitely something to think about. There’s many discarded organs as people sometimes think but there are some. It would be nice to get them included especially when the deceased first and wanted to be a donor. Let me tell you two stories about that. One is in Israel. They’ve now instituted a procedure where if you registered to be a deceased donor or if you are the next of kin of a deceased person and the family consents for donation, you get priority on the waiting list for deceased organs should you ever need them.

They’re not paying money but they’re saying, “In return for an organ, you would get some benefit should you ever need an organ yourself.” That seems to be having a good effect in Israel. I’ve recently been involved in the study of that on the Israeli data. Another story though from the United States is that more and more, we are leaning away from requiring family consent for people who have become registered donors and going towards what’s called first person donation.

The internet plays a big role on that and that which I find a little surprising until I tell you about it. The reason is a lot of Americans, the way we become registered donors is we go to the Department of Motor Vehicles to get a driver’s license and there’s some check off box that we can add our name to the states’ organ registry. The legal framework in which we’re doing that is called the uniform anatomical gift act. The word gift is important because a gift is different than a contract. A contract has consideration, has valuable consideration and so if I say to you, “Why don’t you bring me a cup of coffee and I’ll pay you a dollar tomorrow.” Then when you bring me the cup of coffee, I owe the dollar. If I say to you, “Tomorrow, I think I might give you a dollar as a gift.” Then I can wake up tomorrow morning and change my mind and I don’t owe you a dollar.

An organ is a gift. When you go the Motor Vehicle Bureau and say, “Please register me on the organ donation list and put a little red mark on my driver’s license.” The fact that that red mark is on your driver’s license doesn’t tell us that this morning when you woke up, you had changed your mind. When that was the only evidence that you were a registered donor, it seemed like we still needed family consent. Now, there are websites that hold these registries and you could point your browser at donatelife.gov.california and take your name off the list if you didn’t want it there anymore.

If you die in a way that makes the organs available and your name is on the list, that now starts to look like evidence that you still intended to give the gift this morning. Family consent is becoming less critical and it’s not a giant thing because for registered donors in the United States, we almost always got the organs. There’s a bigger question about the unregistered donors. In Massachusetts where I was more familiar with the data … I moved in 2012 to California. In Massachusetts, we used to get almost 100% of the eligible registered donors but we got more than 50% of the eligible unregistered donors because when you die in a way that makes your organs viable for donation, someone will approach your next of kin and say, “What do you think about donation?” Often the answer would be, “That’s a good idea.”

The organs were missing are mostly unregistered deceased people who aren’t on the list whose families don’t decide to register. It’s good to register. Your readers should … Next time they renew their driver’s license, they should register to be organ donors.

Roger Dooley: One slide that I use in some of presentations involves choice architecture and the difference in donation rates in European countries where many of the countries are up in the high 90% wise and then there are some countries like Denmark and Germany, they are well below 25% with I think Denmark being at 4% or something, ridiculous. It’s not because the Danes are really jerks but it’s the choice architecture thing and the countries are pirates, they’re opted in automatically, they may have opt out and vice versa for the countries with below donation rates.

Al Roth: I think that’s oversimplifying. It turns out the country with the highest donation per million population rate in Europe is Spain and they have opt in. A country with one of the lowest rates is Greece and they also have opt in. I think that the simple regressions on opt in or opt out missed a lot of important institutional detail. The big thing that goes on in Spain is that they’ve professionalize the ask, that is the people who ask families for organs of their departed next of kin do nothing else. That’s what they do.

They are not also surgeons who do transplants and things like that. They may have been trained as surgeons but that give us a lot of incentives to get the organs and I think a culture has developed there where it is understood that it’s good thing to do. In other places, well in Germany for example, on weekends, hospitals are understaffed. In Germany, few people work on weekends and so the available surgeons are busy treating the survivors of auto accidents, not asking the next of kin of the people who die in auto accidents for their organs. It’s things like that. I think they have a bigger effect than opt in and opt out because you mostly do need to get the consent of next of kin.

Roger Dooley: Very interesting. I guess in illustration, nothing is ever … Supposed it seems on its phase. Let’s jump over to business applications. I look at firms like Airbnb or Uber as really being market creating place. Airbnb took unused rooms and turned that into a huge market place. It’s now doing as much business more than major hotel change. Do you think that market creation like that is when you continue to be in an entrepreneurial opportunity or there are loads of markets out there waiting to be uncovered?

Al Roth: I think there probably are and some of what led them to be uncovered now and not before is new technology related to the internet. Let’s go back a little before Airbnb and think about eBay. eBay is a market that had to wait for the internet. You couldn’t do eBay without the internet. When the internet started to be widely available, you could where all of a sudden, you could hold your garage sale for the whole country.

eBay of course has evolved quite a bit. They’re no longer primarily an auction company, another retail channel but they’re an internet marketing opportunity. Uber on the other hand … Why do we see Uber now and not back at the beginning of the internet? Well calling a taxi when you’re at your computer at your desk is not the same thing as calling it on the street. Uber really needed smartphones. Uber became a market place when smartphones became available and you could have the Uber app and call a taxi. Airbnb is somewhere in between but it’s actually closer I think to Uber than to eBay.

Let’s think about Airbnb’s problem in making a market place. When they started, their problem was making a thick market place. That is they had to get homes, rooms for rent in lots of places, not just San Francisco where they started and they had to get travelers in lots of places. They bought up other companies like them and became a bigger market place so that it made sense to look for them when you were thinking of staying at a place that wasn’t a commercial hotel. As they became successful, as their market became thick, it became congested. To understand the congestion problem that Airbnb had to solve before they could be the thriving market place that they are, think about the problem that Hilton hotels would face.

If for some reason, when you call to reserve a room at a Hilton hotel in San Francisco say, you could only inquire about one room at a time. You call up Hilton hotels and you say, “Hi, this is Roger. I’m interested in a room next Wednesday. Is room 587 available?” They’d say, “Sorry. Room 587 is booked.” Then they’ve hang up on you and you’d have to call back and you’d say, “How about room 588?” It would be much harder to get a room at Hilton hotels if you had to work by those rules.

That’s a little bit the way Airbnb has to work because many of its hosts are offering very few rooms, sometimes, just one. At Airbnb, you have to ask for room 587 and if it’s not available, 588. When they started their initial market design was you could try to reserve the room, the host would come home at the end of the day, look at his computer, see that six people wanted his room next Wednesday, he would give it to one of them and he has to write to the others and say, “Sorry. Room 587 is no longer available.” As the site got bigger and bigger, that became untenable.

Now, Airbnb very vigorously encourages its host to use the app on their smartphones and it furthermore made other design changes. If I try to reserve an Airbnb room, even before I’ve got my reservation confirmed even before the host has said I can stay there next Wednesday, the room disappears from the website so you won’t line up behind me and try to reserve the same room. When the host finally does get around to looking what he sees is that I’m interested in this room, I’m interested in booking the room for Wednesday. He doesn’t see six people who all are. That saves you some grief and makes it a quicker process.

Those are market places and their problems as this is case for all market places. There’s this first they have to get thick. They have to get a lot of people to come. Once it’s thick, they have to deal with congestion, deal with how to help you do the transactions that might take some time when there are lots of alternatives. Another problem that market places have to solve is safety. They have to have … If you’re with Airbnb, you have to have insurance for the host. You have to have reputations so that when you reserve a room in my home, you know that I’m not an ex-murderer and the pictures of a nice house that I showed you are actually the pictures of my house and that previous guests have found the rooms clean and the hospitality welcoming.

Similarly with Uber, you mostly only see Uber drivers who have very good reputations because I think they’re pretty furious about keeping out the drivers whose reputations aren’t good. You also have a reputation incidentally on Uber. You don’t always see that when you try to book. If you make drivers wait a lot, you’ll find it harder to get a car than if you come to the door promptly when they arrive.

Roger Dooley: Right. I think starting from the early days of the internet and then the course now being greatly enhanced by mobile, the whole feedback that’s created whether it’s previews or a site reviews on a site like Airbnb or Uber, they are really so important in really facilitating the whole transaction. The taxi companies of course vigorously protest in presenting their market but good grief, can you imagine if many of the taxi drivers out there actually had ratings? These companies would be on a very different market place. The feedback loop in the market I think is really very critical

Al Roth: Absolutely and of course again, that’s especially a phenomenon of internet markets. If you go to a local store and if you go to a local restaurant that you can walk to from your house, there’s a good chance that if it’s been there for a long time, that it serves a pretty consistent quality because if it left you unsatisfied, they’ll probably leave lots of people unsatisfied and they’ll go out of business. Just the fact that it’s just there paying rent in a fancy storefront, it gives you some information. Of course if it’s a local restaurant, you can also ask your friends, someone you know who have eaten there or after you’ve eaten there, you can tell people who you know.

On the internet, when you started off trying to buy something from someone on eBay, they didn’t have a storefront. You had to have some reassurance that they weren’t sitting in an internet café half way across the world making believe that they would send you something. When eBay started, there weren’t even secure methods of payments. People were reluctant to put their credit card information on the web and PayPal hadn’t been invented yet. In early eBay, sometimes, you send postal money orders or something, some form of cash before receiving the goods and you needed the reputation mechanism to let you know that the goods would be coming.

Again, a lot of these things have evolved overtime. PayPal started to be a common mechanism on eBay and then eBay bought PayPal and now, it’s as big as eBay and I guess they’re going to spin it off. Those are new payment mechanisms because they really hadn’t been new credit cards for example in the long time but PayPal came along and we’re going to see Apple pay other forms of paying with your telephone. I’m still thinking about your question of, can people make money still by making markets? Absolutely. PayPal is a market for payments as much as credit cards are markets for payments.

Roger Dooley: Right. I think that’s a really good point because payment is often a pretty important part of the transaction and if it’s awkward or easy, that makes a huge difference. Right now, paying with your phone is still fairly primitive, mostly things you can’t do at all or requires a special app like Starbucks but eventually whether it’s Apple pay or Google pay or some combination, that’s going to really change that piece of the market and might open up some new markets for disruption.

We’re just about out of time, Al. Let me remind our audience that they’re talking with Al Roth, Nobel Laureate in Economics and author of the new book Who Gets What and Why, the new economics of matchmaking and market design. I really highly recommend this book whether you just want to learn something or whether you want to spot a market that’s wide for disrupting and want a blueprint for how to do that. We will have links to Al’s book and this blog on the show note’s page. You’ll also find there the text version of this conversion and it will all be at rogerdooley.com/podcast. Al, thanks so much for being on the show. It’s been a lot of fun talking to you.

Al Roth: Thanks for having me, Roger. It was fun talking to you too.

Thank you for joining me for this episode of the Brainfluence Podcast. To continue the discussion and to find your own path to brainy success, please visit us at RogerDooley.com.