What makes a superconsumer, and why are they so important? Today’s guest, growth strategy expert Eddie Yoon, is here to answer those questions and more. Eddie is the founder of the growth think tank and advisory firm, Eddie Would Grow. He has helped numerous businesses—ranging from cable media to pet food, and from consumer robotics to standby generators—go from several hundred million to nearly a billion dollars.

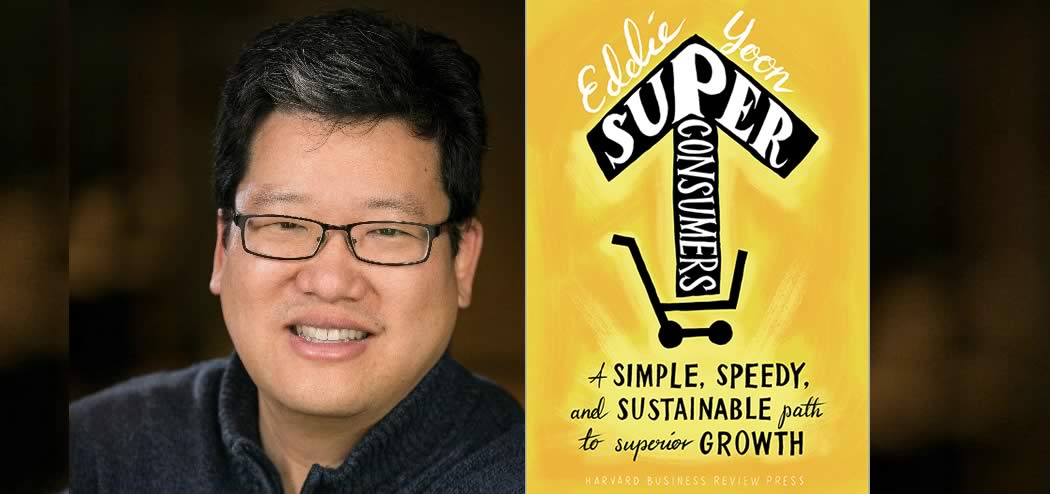

Eddie is also the author of the acclaimed book, Superconsumers: A Simple, Speedy and Sustainable Path to Superior Growth (Harvard Business School Press, 2016), as well as over 40 articles. He is a regular contributor to Harvard Business Review, and has been a keynote speaker in the U.S., Africa, Australia, Denmark, the UK, and Japan.

Today, he’s here to share what makes a superconsumer, and why marketers need to understand how to reach them for the sake of growing their businesses.

If you enjoy the show, please drop by iTunes and leave a review while you are feeling the love! Reviews help others discover this podcast and I greatly appreciate them!

Listen in:

Podcast: Play in new window | Download

On Today’s Episode We’ll Learn:

- Why all marketers should understand superconsumers and know how to find them.

- How to utilize your own data to identify superconsumers.

- What you need to make sure you’re not wasting your time as a marketer.

- Three things required for category growth.

- Why credibility can be more powerful than fame.

- The dangerous misconception surrounding superconsumers.

- How to identify and avoid autopilots (and why you need to).

- Eddie’s biggest piece of advice for entrepreneurs with limited marketing resources.

Key Resources for Eddie Yoon:

- Connect with Eddie: Website |Twitter

- Amazon: Superconsumers: A Simple, Speedy and Sustainable Path to Superior Growth

- Kindle: Superconsumers: A Simple, Speedy and Sustainable Path to Superior Growth

- Audible: Superconsumers: A Simple, Speedy and Sustainable Path to Superior Growth

Share the Love:

If you like The Brainfluence Podcast…

- Never miss an episode by subscribing via iTunes, Stitcher or by RSS

- Help improve the show by leaving a Rating & Review in iTunes (Here’s How)

- Join the discussion for this episode in the comments section below

Full Episode Transcript:

Welcome to the Brainfluence podcast with Roger Dooley, author, speaker and educator on neuro-marketing, the psychology of persuasion. Every week we talk with thought leaders that will help you improve your influence with factual evidence and concrete research. Introducing your host, Roger Dooley.

Roger: Welcome to the Brainfluence Podcast. I’m Roger Dooley. I know a lot of you find these conversations useful from the emails and comments on social media I get. If you were one of those people, please feel free to let me know which episodes and themes you find most interesting, and, of course, please leave a short review at iTunes or whichever podcast service you use.

Our guest this week is going to tell us what a superconsumer is and how you can identify these customers of your business that can make a huge difference in growth and profit. Eddie Yoon is a growth strategy expert, and the founder of Eddie Would Grow, a growth think tank and advisory firm. He was a partner with the Cambridge Group for 18 years. For our neuromarketing fans, I’ll point out that the Cambridge Group is part of Nielsen, which also has a large consumer neuroscience division that encompassed what were previously neurofocus and interscope research.

Now, Eddie’s worked with a great variety of businesses ranging from cable media, food brands, beverages, pet foods, consumer robotics and even standby generators. His new book is “Superconsumers: A Simple, Speedy and Sustainable Path to Superior Growth”. Welcome to the show, Eddie. You’ve got some great alliteration going on in that book title. I guess there wasn’t a synonym for growth that started with “S”, otherwise, that would’ve been in there too.

Eddie: I hit the thesaurus pretty hard for this title, so yes.

Roger: Alliteration’s actually a great marketing tool. There’s research on that, and scientists think it’s a cognitive fluency effect that the alliteration somehow makes it easier to say and recall.

Eddie: I have to say, I used to make fun of people who would overdo it until I realized … I think there’s clearly some people who like it and some people who probably like it less, but it is easier for me to remember, and I figure, if it’s easier for me to remember, then it’s easier for the audience to remember. At the end of the day, you want it to be useful. And being able to call it up from your memory is one of the first things you need.

Roger: Yeah, well that’s good. So, off to a good cognitive start here. Before we get into the concept of superconsumers, Eddie Would Grow is an unusual name for a consultancy, Eddie. I’m guessing there’s a story there.

Eddie: Yeah, yeah, yeah. It was based on this gentleman named Eddie Aikau. I was born and raised in Hawaii, and Eddie Aikau was a iconic, what we call a water man. So he was a big wave surfer, a lifeguard. He saved 500 lives without losing anybody and kind of this preeminent Hawaiian navigator. His backstory was … the catchphrase “Eddie Would Go” is kind of the one that I’ve borrowed, which was him and his courage to take off on the biggest waves. Then actually, when he was part of a celestial navigational tour with Hokule’a, they run into some trouble outside of the island and the boat capsized. And he actually swam for shore to get help and they never saw him again. To me he stands for courage and generosity, and these are the things that I believe are really critical for marketers to grow their businesses today.

Roger: That’s great. It’s kind of an inside thing, but now all of our listeners know the story too.

Eddie: Absolutely.

Roger: The Cambridge Group, on the other hand, that’s exactly what you’d expect for a consultancy. It’s really formal, it’s got this tie to Cambridge where you figure there’s a lot of smart people at both Cambridges actually. When did Cambridge become part of Nielsen?

Eddie: Cambridge was acquired by Nielsen I want to say about eight years ago. What was really kind of fascinating was, there’s a gentleman by the name of Jim Kilts, who was the former CEO of Gillette and Kraft, and he had been a long time Cambridge client. He was actually one of the early investors that had taken Nielsen private and then eventually took it public again. Apparently he had this long time wish for Cambridge and the growth strategy that we would do there to come together with the data assets of Nielsen. It took him some time, but eventually the two came together and he thought that it would make for a perfect match.

Roger: I guess their neuroscience acquisitions came a little bit after that. Did you ever happen to work with or interface with the neuroscience people?

Eddie: Sure thing. Absolutely. Nielsen was on an acquisition tear for a while, and so Joe Willke and the neuroscience and the neurofocus folks. I’ve loved all of what they’ve done, the ability to take a 30-second ad and shorten it to the 15 most impactful seconds. I think we’re just on the cusp of all the great stuff that could come out through marketing excellence through that type of science.

Roger: So on to superconsumers, Eddie. What’s your definition of a superconsumer, and why did you write a book about them?

Eddie: My definition is somebody who buys a lot and cares a lot about a certain category. Part of the reason why I decided to write it was that I just kind of found … When I was at Cambridge, my clients had driven about $5 billion worth of growth, be it through innovation or portfolio strategy or new markets or business model reinvention, and I just kind of saw the same thing happening over and over again. And it occurred to me that in this day and age, where business has become so much more competitive, your partners are turning into frenemies and you don’t really have much time to make decisions, that it might actually be better from a growth strategy perspective to get results to have something very simple and easy to activate across all the data that you have, versus something that’s very complex that takes a while. And meanwhile you’re playing speed chess and you’re just getting crushed by your competition out there.

A lot of that was just kind of based on (1) the evergreen tenets that had worked in my experience and my career at Cambridge, but (2) having access to the big data at Nielsen, as you were describing, Roger, was … it was just awesome to see that this theory that I’d had for a while, that the Cambridge Croup had had for a while, was proven out category after category. When I would look at the data and we would integrate different datasets of what people were buying and some emotion that they had as well too, which is a pretty rare combination, what I found was that these superconsumers they existed in 125 different categories in the US with $400 billion worth of sales. They existed in the global datasets.

And even beyond the categories that Nielsen would measure, I have yet to run into a category that doesn’t have this dynamic, be it consumer packaged goods, be it in the business to business front it’s often the case it’s even more extreme, or technology and media. I just keep running into it. So I figured I better document what I found over time so that more people can use it and get after it without even my help necessarily.

Roger: Mm-hmm (affirmative). Great. Well, we’ve been influencer marketing for years, and now superconsumers aren’t necessarily the same people as influencers, but is there an overlap between those two?

Eddie: Yeah, there’s certainly an overlap. I think it’s, to your point … This to me is a bit of like we’ve always had peanut butter, we’ve always had chocolate, but putting it together seems to be a good combination. People who are influencers because they have a big voice, but it’s not just because they have a platform but because they are actually themselves avid users and smart and articulate about what the benefits of the category are. I think that combination together … because you can have people who buy a lot of a certain thing, but they may not care about it, and that doesn’t really help you as much. You have people who care about something but they’re not actually using it or buying a ton of it, and that lack of integration is actually the missing link. People that I have found, regardless of if they have actually a big platform, kind of a no-name anonymous consumer who is a superconsumer of something, is constantly influencing the people around them in a way that I think is powerful and an untapped opportunity for most marketers.

Roger: Okay, so they might be mini-influencers, not really recognized as such by their following, but they’re influential among their friends, right? One of your early examples, Eddie, is a lady named Sally who had kind of an office supply fetish I guess. I’ll let you explain about Sally.

Eddie: When it comes to the superconsumer thing, we always say everyone is a superconsumer of something, so there’s no judgment here. You just come as you are with it. As to your point with Sally, the woman I met who was just a superconsumer of office products. In particular we found was staplers was a category that when I walked into it at first I was like there’s no way this is going to be of any interest. And actually one of the major retailers at the time, Staples, agreed that this was a no-involvement category, that we should push private label and cheaper products. What I was struck by was when we actually dug into the data that a third of the consumers drove 70 to 80% of the profit in the stapler category. We’re like how can that be for an uninvolved category.

It turns out a stapler is something that you only bought once every five to seven years. I mean, you only typically bought it when yours broke or you lost it or something to that effect. What was really interesting was when we kind of isolated these people who were driving most of the profit, what we found were some common themes. Kind of the obvious one was that they used it a lot. So someone … In addition to Sally I remember was a woman who worked in the New York Opera box office, and she went through a box of 5,000 staples in a weekend. So you think about a stapler maybe jams on you once every 100 times, but if you use it 50 times a year, it’s a once every two year problem. But for her, she was having the stapler jam up on her 50 times in a weekend, and it was affecting her work. It was affecting how she felt about herself, because she couldn’t do her job well.

The clear answer became what if we gave you an electric stapler or a heavy duty one. And it turned out they were really excited about this idea. It’s not a new idea that they hadn’t heard of, but they had never thought of getting one. When it turned out that they could justify it because it was actually about work productivity. What we actually ended up doing was, based on this woman and Sally’s input, we said let’s reinvent the retail shelf set so that it would appeal to superconsumers of staplers. So we put these … and I’m going to geek out on you a little bit, Roger … these beautiful heavy duty staplers, these amazing electric staplers, that basically what happened was they would not jam. They could take more paper or, a lot of jamming is human error, so the electric stapler would take that out of it.

When you actually did that, you had people who were walking in once every five to seven years, looking to buy a $7 stapler, walking out with a $30 heavy duty or in some cases a $70 electric stapler. This was the secret to the strategy, it was basically a trade-up strategy driven by these people. We put these huge signs that said “anti-jamming” on them at the store. And two out of the three office stores said, “This is great. We’ve never seen this kind of data around anyone about staplers, and so let’s do this.” And they totally reinvented their shelf sets. Their sales went up 19% year over year, which was amazing for a category that was flat. We did no TV advertising, one of the traditional marketing tools you would think.

Based on the knowledge that these people who were superconsumers were shopping, they were willing to trade up if given the right benefits. And, this is the best part, if the average person goes into an office superstore maybe four to six times a year, these people were in there four to six times a month because they just liked browsing those aisles. Then they’d, “Oh, I need to go pick up some paper, but I’m gonna walk down this aisle.” So it was a great way to intercept them. The way that I know proof positive that this worked was the one retailer who had rejected this premise, were like these people do not exist, literally in that same nine-month time period where the other guys grew 19%, that third retailer shrank by 9% at the same time because they had done nothing to change.

Roger: You know, I think Sally’s a great example of another thing, that even business to business, buying decisions involve emotion and non-conscious factors. People ask about that all the time when I talk about these things. They’re willing to believe that consumers will make emotional decisions, but don’t think the same thing happens in business, or gee, it’s just all about the price, the performance and so on. But obviously that’s not true. I typically argue against that point too, because every business buyer has non-conscious factors at work. In some cases it might be an irrational love for office supplies, but in other cases it may have to do with how is this going to affect me personally and my advancement and my … is this going to make me look good or is it going to make me look bad. Even if they’re not fully aware of it, those things are going on.

Eddie: It’s funny that you mention it. I’ll take you from a very extreme example from Sally to somebody who was a real estate buyer for a retailer buying HVAC equipment. So he’s in ventilation and air conditioning compressors and valves, and the client that we were working with at the time had come out with these smart compressors and valves with sensors and wireless capability, and they thought people are going to love this because it will save them electricity. And what it turned out that the real estate buyers, they were superconsumers of this product, and what they were begging was, “Hey, my retailer, we’re not as good as some of the other ones, we only grow through acquisition, and when we buy somebody else’s stores they come with HVAC valves and systems that I did not put into place. And so I don’t know how they work, and when they go haywire, they call me and complain about somebody else’s problem that they put into place, and it drives me insane. For the love of God, will you stop selling me these replacement parts and just sell me a whole new system, and put it as a pitch of the total cost of ownership will come down.”

Basically the real estate guy was teaching the sales guy and the marketer to upsell to the CFO that let’s make this a capital expenditure versus a service call, because it will make my life easier. And it’s exactly to your point there.

Roger: Just for the sake of argument, there’s a limit on how much product the Sallys of the world can buy. Once she’s got that high end stapler, maybe the other people in her office have it too even if they aren’t quite as demanding, eventually she can’t quite fill up the closet with staplers. I would guess that some folks would say it would make more sense to concentrate on offices or buyers that could just generate more volume. In other words, if Sally was in this relatively small office, she may be a superconsumer, but why not focus on an office that has 1,000 people in it, say?

Eddie: It’s a great question. The benefit of Sally, certainly there’s a benefit to their buying power alone, which is … it’s still pretty significant. The top 10% from the Nielsen data would say that generate anywhere from 30 to 70% of category sales, but the more important part is that they generate 99% of the insights for how to grow the category. The reason why Sally and her superconsumer kind are so important is that I always say that if you don’t have a vision to double your category then you’re kind of wasting your time, right? Because the vast majority of marketers and companies that I run into, when you kind of boil their growth strategy down, it’s what I call pie splitting. It’s Roger, we both compete in staplers and you have a slice of the pie and I’m going to take it from you by copying your product or outspending you or undercutting your pricing.

The long term way to grow is to grow the category or to create an entirely new one. My data and my research has found that 1% of the brands capture 80% of the category growth upside. And that’s significant because in the Sally story … So the three levers of category growth are can you bring in new users, as you said, can you increase units per user, or can you increase price per unit. The stapler story was clearly around driving price per unit up through heavy duty and electric trade-up. But it is in fact to your point that these supers will teach you, you know what, they have new use cases that might actually appeal to people who never bought these things in the first place.

I’ll give you a different example in the office products category is you have a hole puncher, a pretty basic thing for three-ring binders and whatnot. Then what we discovered was this brand Fiskers had these single hole punchers that were four times as expensive as a regular one. We’re like what’s going on there? Instead of punching a hole, it would punch a heart. It would punch a little doggie. Same size, right? Little shapes and this and that. We’re like what in the world? It turned out to be this whole kind of stamping, crafting subculture that was really quite interesting there. One simple modification took what was basically a commodity category and turned it from a functional office use to something that was actually fun. And they were able to increase their price premium by 400% by doing that. And that allowed you to not only bring in new users into the category but bring in new units per user, because guess what, if you like the heart, you gotta have the one that does the arrow through the heart and the doggie and the cat one after that. And you can drive category growth there.

Roger: Okay, so if I’m the CMO of a larger organization or maybe an entrepreneur with a smaller group, how do I go about identifying these superconsumers? Say that you’ve sold me up to this point, how do I find my superconsumers?

Eddie: This is the part that I find is the best part about it, is it’s actually pretty easy in that … To some degree, I’ve been trying to figure out a way to make myself and my consulting role a little less relevant, because I’d rather spend less time on the data collection and more time on figuring out what to do. And the reason why it’s easier now is … A couple things are that superconsumers are … they’re all around you. What I always say is that you probably, especially if you’re in a consumer category, you have superconsumers in your category around you in your friends and family.

So number one, just kind of look around, and you kind of discover like oh yeah, my Uncle Ned is really into X, Y and Z, and they’re a really good person to talk to. Number two is that these superconsumers, they leave digital bread crumbs, right? My definition is that they spend a lot and they care a lot about the category. So most of us don’t work for companies that are the hot new tequila brand or Under Armour’s latest athletic gear. But if someone is taking the time to post online about a stapler or tweet about a pen, some kind of a seemingly mundane category, they’re probably a superconsumer. Someone who’s taken the time to sign up on your website or get a listing from you, they’re probably a superconsumer, because how spend your time is as telling as how you spend your money.

Roger: I think the point there too, that person who tweets about their stapler, they might only have a few dozen followers, which means they’re definitely not an influencer, but nevertheless they may still be a superconsumer.

Eddie: Oh absolutely. And I think it’s to your point of like everyone’s dream is to have someone really famous with millions of followers to push your brand out there, but there’s something about the person you know, Roger, that they’re not famous but they’re credible. Oh yeah, that guy is super into that and I trust their opinion implicitly. I was in Copenhagen talking about the book, and this journalist was talking to me about … after he had heard me talk about it … was like, “You know, I used to ride motorcycles when I was a kid, and when I got married my wife made me give it up. And then now that our kids are out of the house she let me get back into it, and I went to this friend who told me to talk to this superconsumer of motorcycles. And I said I’m gonna get back into it. These are the two motorcycles I’m gonna get. And this superconsumer said no, you’re gonna kill yourself, you’re gonna waste your money. Strike those brands. Look at these three, and I would recommend number two within this.”

The influence that they have that’s under the radar is extraordinary because … One of the things I write about in the book is this business American Girl. I don’t know if you have daughters or you know this business or brand.

Roger: I know of the brand.

Eddie: Okay, great. These are much more higher quality, eight to ten times as expensive dolls as a Barbie. They come with a backstory, books and movies, and the retail stores are an entire experience of itself where not only can you buy the product but you can actually sit and have tea with your doll. And be charged huge sums of money.

Roger: Who wouldn’t want that?

Eddie: Who wouldn’t want that indeed? The thing that we found was that the best way to get someone to buy more American Girl is to have their daughter play with another girl who had more than they did. It’s not someone more famous. It was just that “Daddy, my friend has this and that and I don’t. Can you get that for me?” One of the things that it really did was it changed the mindset of how they ran their business, because catalogs and direct mail and marketing was a big thing of what they did, and so they might say I would have measured the ROI of Roger’s house. I sent you a catalog, did you buy?

And what they shifted from was what I call these supergeographies, where superconsumers they’re birds of a feather, they’re clustered together. And when they gather together, they actually have an outsize influence on the other people around them. And so what we found was that measuring ROI at the Zip Code level was actually the better way of doing it, because it wasn’t so much that I sent you a magazine and you didn’t buy, or you did buy, but it was did somebody else see it and did your … the connectivity that happens from it there.

I think this idea of … a last bit of it I’ll tell you is, in terms of finding these superconsumers, is that they’re in your data already, and if you just look for anomalies and spikes, that’s what you really, really want. The two words that I hate the most in business is average and national average. We want so many of our metrics, be it a big company or small, kind of on average this is that, and you’re smoothing out all the beautiful spikes in your data that were kind of the telltale signs of when a superconsumer might be present or a superconsumer behavior might be there. So I always say just get any data that you have, whether you’re a big company or a small one, rank order it high to low, and look for things that seem unusual and out of place. And that’s usually another bread crumb in your data that superconsumers are there.

Roger: Changing the subject slightly, you talked about autopilots. What are autopilots?

Eddie: Yeah, these are people who they buy a lot but they don’t care a lot about the category. This is an important distinction, because a lot of people think that when I’m talking about superconsumers, they’re oh, you just buy a lot. But it could very well be like someone who may look like … Two receipts, let’s say you and I, I can see how much money you’re spending on bread, and you see how much money I spend on bread, and they’re both high. But maybe I’m spending a ton of money on bread because I have three teenagers at home and they’re just endless, bottomless stomachs of consumption of food, and I’m just going through sandwiches all the time, but I could really care less about the category. That’s somebody you want to avoid, because almost anytime you go to that person they’re going to tell you make it cheaper, make it easier, but they’re not going to really help you figure out how to grow the category in a meaningful way.

This is the distinction of this autopilot behavior. It’s not really changeable. You’re not going to learn much from them. And so they’re really kind of dangerous in that they might look like a super from the outside but once you talk to them and engage them they’re not going to give you really good advice. That’s the people you have to figure out how to avoid.

Roger: I guess, jumping over to your craft beer example, a Budweiser might look at the person who buys a couple of cases of Budweiser every time they go to the supermarket as a big consumer and the person they should be catering to, but that person might really be an autopilot and might have led them to make decisions like double IPA, our big customers are never going to touch that stuff. Which might be true. That high consumer might not be the best candidate for a craft beer with a somewhat more unusual flavor, but they certainly missed the boat, didn’t they?

Eddie: You hit the nail on the head there. You said a couple of key things. One is the buying behavior alone doesn’t tell you enough. And number two, heavy buyers of your brand … like that’s actually one of the biggest misconceptions of what I’ve talked about is that I really want … If they had been focused on heavy buyers of the category, that tells you something really different, because you would have spotted that IPA, the double IPA thing, happening way sooner, whereas if you’re just staring at the people who are buying suitcases of Budweiser, then you’re not going to see the disruption coming there. And in fact, one of the biggest things that I found from the Nielsen data that was really fascinating was a superconsumer of one category is a superconsumer of nine others, some of which are obvious and make sense. But you kind of have to look at the data in totality to really understand the unmet demand that’s there, because to your point, you want to look at a superconsumer not of Budweiser but of beer, and that would tell you the craft beer thing is big.

But if you look at … There are people who drink beer, wine and spirits. They’re not kind of loyal to one or the other, but they like them all across the board for different situations and different occasions. That kind of broad dataset actually ten years ago when Anheuser launched Bud Light Lime, that dataset cross-sectionally across category was actually the inspiration that got them to figure out what to do, which was wait a minute, craft beer is growing … our high end beer … but Corona is actually 44% of the growth and that the wheat beers are growing at a disproportionately higher volume than some of the double IPAs. Because you might like a double IPA, but you can’t really have many more than a few of them just given the bitterness of it.

And the same people who are drinking Corona and Blue Moon, things that you put a citrus into, were driving growth in spirits, but not the whiskeys and Scotches, it was the flavored vodkas and the rums, things that are stylish and slightly sweet. And you saw the same pattern in white wine. And so what they concluded was there was an unmet demand for a new version of a palate that was slightly sweeter beverage alcohol. But the brand still had to be important. It couldn’t be Zima, a brand that tasted good to a sweeter palate but wasn’t very aspirational. It had to be a mainstream or an aspirational brand. And that’s what gave them the courage to actually launch Bud Light Lime, which was a very controversial thing, to kind of go after this. That plus Bud Light Platinum and Bud Light Lime-a-Rita ended up being a billion dollar platform, 30% higher margins for them, the most incremental innovations that they’ve launched and actually turned out to be the best way for them to compete with spirits without having to write a big check and make an acquisition in that space.

Roger: Mm-hmm (affirmative). I get how somebody who is into craft beer might also be into say single malt Scotch or something, but you imply that sometimes these connections aren’t logical. Is there a personality type that makes a person a superconsumer? Or do you have any examples of sort of weird synchronicities between superconsumption and different spaces?

Eddie: Absolutely. You had mentioned in my intro, one of the clients that I work with is Generac. They are the number one provider of standby generators. This is a hard category to sell. Basically, if you had a weather event like a big Nor’easter or a bad hurricane and the power went out, then they would sell a lot of these. But if there was no problem with your power, then why would you pay seven to 10 grand for a product you’ve never heard of for a need you may never have? The superconsumer version that we found for them wasn’t that people were buying two generators, which doesn’t make any sense, but these were people who were buying a generator without a reason to buy them. So they were kind of buying them off-season as it were.

We dug into them and said you’re kind of this odd consumer. What’s going on here? And what we found out was that these proactive people, they were superconsumers of life insurance, they had three to four times the amount of life insurance than they actually needed. They were superconsumers of vitamins, so you go back into the consumer goods space that they were buying a lot of these vitamins and a kind of similar kind of benefit as life insurance.

Roger: So sort of paranoid pessimists.

Eddie: Yeah, and couple that with the whole Boy Scout “Be prepared” thing. The best part was-

Roger: Probably tinned meat would be a big category for them too.

Eddie: Funny you should mention that. It was actually they had three or four refrigerators and freezers, because they just loved to store food. Frozen food, a lot of meats and whatnot. The angle became really interesting, because once you kind of realized, as you describe, Roger, these paranoid pessimists who are prepared in all angles of their lives … To your point about the psychology or the personality type, usually there was some sort of an event that might have happened earlier that … formative from their family origin … that made them really want to protect their family against any and all eventualities.

But regardless, it totally changed their mindset of how they marketed to them, because before they were talking about the technical specs, kind of thinking about that, and they really shifted it to testimonials. It was, “Hey, I have $3,000 worth of food stored up, so if the power goes out I’m kind of out of luck.” You know, spending 10 grand to protect three grand. Not a bad deal. Or it became, “You know what, the power went out and we couldn’t find a hotel, and my dog couldn’t get … They wouldn’t take my dog, and therefore we needed to get one.”

My favorite one, Roger, we talk about the psychology of this, I had a superconsumer, this proactive buyer of a generator, draw somebody who was like him. And this guy drew this Empire State Building, this huge guy with muscles and a cape flowing from here. I’m like, “What in the world are you drawing here?” And he kind of was sheepish, and he was like, “All right, I’ll tell you what’s going on in my head here is that I can’t wait for the power to go out, because the day the power goes out, you’ll see me out there with a glass of wine in one hand in the total darkness. And my house will be the only house illuminated in the whole neighborhood, and I know all my neighbors will be looking at me and saying he is actually better than they are.”

It was a total ego play that we had not anticipated. It was the whole it is so fun being the king of the hill. Can you please … Come over and take a shower, yes you can do that. Come over and grill your food. That’s the goal that he was really trying to get at. It goes back to your point about emotion. It’s not about the technical specs per se, but you’ve got to just tap into that as well as the emotion, and that’s how you get pricing power. That’s how you pull people through when they don’t have a need for it originally, and that’s the power of superconsumers that I found.

Roger: That’s a message that I’m constantly hammering away at. I mean so many companies are product focused, because they’re proud of their product, you know? It’s good, it’s better than the competition, it’s better than last year’s product, and yeah, they have a right to be proud about it but that’s not necessarily how you’re going to sell it. I have a vision of an ad for those generators of this big neighborhood that’s completely dark, but there’s one little house that has bright lights all around it. I think that could probably appeal to people, you know?

A lot of our listeners are entrepreneurs and deal with limited marketing resources. They don’t necessarily have big datasets. They don’t have access to Nielsen’s or anybody else’s big data. What’s one piece of advice that you would give them, Eddie, into trying to implement your ideas?

Eddie: Yeah, you know I would say make some friends. Let’s go back to kindergarten, right? And just find a couple of superconsumers that you can build a relationship with personally. That’s probably the best advice that I could give you. I had a friend who kind of left big corporate America to open up a sandwich shop, and when I talked to him about what I was writing about, he was like, “You know, I have a couple of regulars that I always see. I don’t really have much of a relationship with them other than we say hello.” And he changed that from a transactional thing to a relational thing. And they became some of his best, not only evangelists but best advisors for I’m thinking about doing this, what do you think. No, no, no, that’s not why I use this product for.

The whole thing about this is that … I think it’s to your point, Roger, like too many of us worship at the altar of what we make. We’re proud of our products and rightly so. We’re proud of our brands and rightly so. But the consumers, especially the superconsumers, I found that they are the MacGyvers of consumption in that they use our brands and products in radically different ways than we ever imagined, and that’s the reason why they spend a lot. And you’re not going to really understand it until you have that empathy and that personal relationship there. I actually think this is the part that’s really cool, is that smaller businesses have a great advantage over big companies, because I can’t tell you how many big companies that I run into where the leadership that run those companies, they are themselves not only not superconsumers but they’re not even consumers of what they make.

That distance and lack of empathy I think really hurts them in the long run. It’s part of the reason why some of the biggest brands are struggling right now. And so I would say go and find your supers, make some friends, take them out to lunch, build a long term relationship with them, and be open minded to learn from them. Almost like a superconsumer board of directors as it were.

Roger: Great advice. Let me remind our listeners that we’ve been speaking with Eddie Yoon, author of the new book “Superconsumers: A Simple, Speedy, and Sustainable Path to Superior Growth”. Eddie, how can our listeners connect with you and your content online?

Eddie: Sure thing. You can find me … I write particularly for HBR and for Inc. Magazine. So if you want to see the latest of what I’ve written, you can follow me on Twitter. It’s @eddiewouldgrow. And then my website is www.eddiewouldgrow.net.

Roger: Great. Well we will link to those places and any other resources we spoke about on the show notes page at rogerdooley.com/podcast. And you can leave a comment there too and grab the text version of our conversation. And once again, please don’t forget to leave a review at iTunes or wherever you get your podcasts. Eddie, thanks for being on the show.

Eddie: Thanks, Roger, for having me.

Thank you for joining me for this episode of the Brainfluence podcast. To continue the discussion and to find your own path to brainy success, please visit us at RogerDooley.com.