Ralph Welborn has a provocative theory about the business firm as we know it. Today’s guest is CEO of CapImpact, a predictive analytics and advisory firm focused on new growth models, and he says the way most businesses do things today isn’t the best way to create growth and profit.

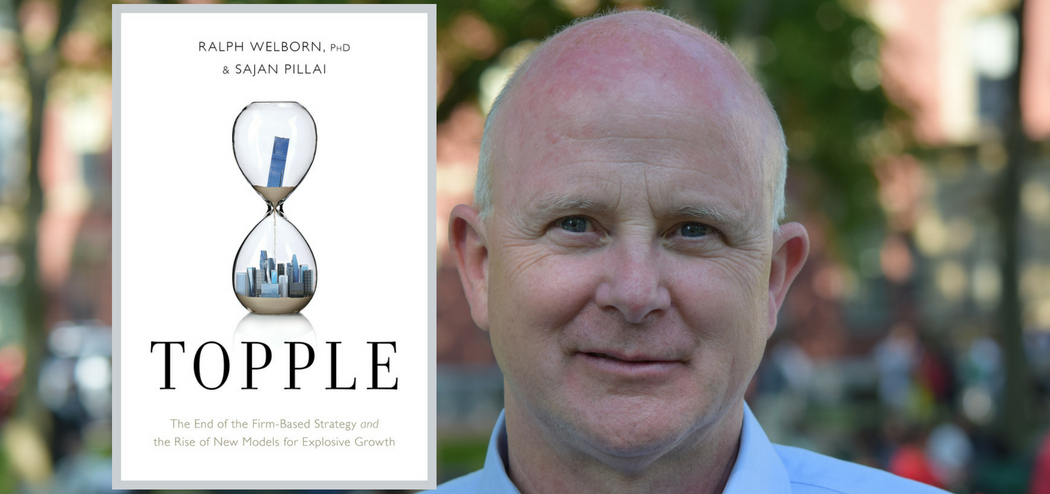

A former senior executive at both IBM and KPMG, Ralph spent 25 years advising public and private sector firms around the world. He joins the show to share insights from his new book—co-authored with Sajan Pillai—Topple: The End of the Firm-Based Strategy and the Rise of New Models for Explosive Growth. Listen in to learn how the competitive landscape has changed, what it means to look at it through the lens of business ecosystems, and the important questions businesses should be asking themselves when planning their strategies.

Learn how the competitive landscape has changed and the important questions businesses should be asking themselves with @ralphwelborn, author of TOPPLE. #business #growth Share on X

If you enjoy the show, please drop by iTunes and leave a review while you are feeling the love! Reviews help others discover this podcast and I greatly appreciate them!

Listen in:

Podcast: Play in new window | Download

On Today’s Episode We’ll Learn:

- Why Ralph says most businesses aren’t optimized for today’s world.

- Key questions businesses should be asking when planning their strategies.

- The fundamentally new way of engaging with customers that leads to explosive growth.

- Why the Red Queen from Alice and Wonderland is a great metaphor for the state of business today.

- Where explosive growth comes from.

- Important lessons from growth leaders.

- What Ralph says is the reason over 75% of the digital transformation efforts are failing to deliver.

- The difference between an ecosystem and a platform.

- How to determine total ecosystem opportunity.

- What businesses can do to engage within an ecosystem.

Key Resources for Ralph Welborn:

Share the Love:

If you like The Brainfluence Podcast…

- Never miss an episode by subscribing via iTunes, Stitcher or by RSS

- Help improve the show by leaving a Rating & Review in iTunes (Here’s How)

- Join the discussion for this episode in the comments section below

Full Episode Transcript:

Welcome to Brainfluence Podcast with Roger Dooley. Author, speaker, and educator on neural marketing and the psychology of persuasion. Every week we talk with thought leaders that will help you improve your influence with factual evidence and concrete research. Introducing your host, Roger Dooley.

Roger Dooley: Welcome to the Brainfluence Podcast, I’m Roger Dooley, our guest this weak has a provocative theory, the business firm as we know it, may not be the best way to create growth and profit. Roth Welborn has been a senior executive at IBM and KPMG and has spent 25 years advising public and private sector firms around the world.

Together with Sajan Pillai, he’s the author of the new book, Topple: The End of Firm Based Strategy and the Rise of New Models for Explosive growth. Welcome to the how Ralph.

Ralph Welborn: Hey, thanks, glad to be here.

Roger Dooley: Yeah, so Ralph I’m guessing that many of our listeners can identify with the Red Queen from Alice in Wonderland. She’s the character that’s running faster and faster but stays in the same place. Why is the Red Queen such a good metaphor for the state of business today?

Ralph Welborn: Precisely for what you mentioned. She does run faster and faster and stays in the same place. And I found her inept analogy for many, many business, wherever I happen to go around the world is that so many people invest in the same type of methods and technologies in similar ways.

And so, from that point of view, a logical question comes, if you’re doing that how can you possibly expect to be in a relatively different place than you are today? You know it’s interesting, no matter where I am all I have to do is describe go and they go, “Oh, yeah, we’re running a Red Queen race.” So the question becomes, how do you stop running a Red Queen race? What can you do?

Roger Dooley: Mm-hmm (affirmative). Yeah, I guess it’s really easy for companies to focus on what appear to be simple ways to improve. You know, get more done with the same number of people or reduce head count a little bit and keep doing the same amount. Make some simple product line extensions and so on, but that’s clearly not the way to create disruption in your industry.

Ralph Welborn: Well, you know it’s interesting, I’m not even so sure it’s … forget about disruption. I think it’s really is about competitive survival. And so if you believe in the Red Queen, if you see her running and then you might be running the Red Queen race you only have three options. One you can ignore her and a lot of people do that.

Secondly, you could try to outrun her and that is exactly what you mentioned. Do more, better, faster, cheaper, type approach. And that works for a while but it reminds me of Greek Mythology from old eighth grade. And think about what happened to those Greek heroes. Those heroes who ran better, faster, cheaper. They died.

And so this whole idea of trying to out-execute people by running better, faster, cheaper in the long-run just doesn’t work. So the third option is you gotta do something different. And so, simply doing more, better, faster what everyone else is doing is gonna keep you running the Red Queen race.

And I passionately believe that there are some fundamental shifts that have been going on that have made that running her race and trying to out-execute people even more of a disastrous decision to make overtime.

You know, it’s interesting from that point of view, don’t take my words for it. If you actually just take a look at some data, which is incredibly interesting, so the topple rate, the rate at which people fall from their relative position in their industry is accelerating. So, over 70 percent of firms that were in the fortune 500 20 years ago aren’t there anymore. And people are now starting to do their research for the mid-market and others as well.

And that topple rate or the rate at which people are losing out to their competitors or not growing much compared to their competitors is accelerating and getting bigger. And that’s an indication that you’re running the Red Queen race and something’s gotta give.

Roger Dooley: So, Ralph, most of our listeners are part of a business firm, some maybe with a non-profit organization, but particular for those in business, whether it’s a big company or small one, they’re organized around the company’s customers, markets, shareholders, owners and so on. You say businesses are not optimized for today’s world. They’re optimized for a world that no longer exists. What do you mean by that?

Ralph Welborn: What I mean is that if you take a look at industry’s they’re approximately 20 percent of capabilities, by which I mean skillsets, behavior patterns, and technology assets that drive about 70 percent of the value you deliver or the outcomes that you deliver, whether you’re in the private sector or public sector.

So, the 20 percent of capabilities that have made you successful today are not the same 20 percent that you absolutely need tomorrow. And that’s what I mean, is that if you take a look at what’s going on in terms of who’s growing and who’s not growing, the ones that are really struggling are the one’s who haven’t identified what that new 20 percent is.

And the reality is technology’s advanced, markets shift, customer expectations change. And so, for trying to deliver and engage with that environment with the same set of capabilities that made it successful today with what’s needed tomorrow, it’s not gonna work.

Let me make this really tangible. I was working a senior executive at a regional insurance company not too long ago, and we were wrestling with this concept of the new 20 percent. He said, “Today, the insurance company, all insurance companies and his companies,” he said, “we make our value. have made our value by our 20 percent is around how we price risk. It’s all around protecting that risk book.”

He said, “What happens in a world if instead of pricing risk, we need to prevent accidents?” And his comment was, and he kept pacing, he said “Our capabilities to price risk are fundamentally different than they are to prevent accidents. We’re gonna need better insights into telemetry into life stages in terms of how people are behaving, in terms of predictive analytics, much more than we ever had to … ran a pricey risk thing.”

And so, that’s what I mean. Businesses are optimized for a world that no longer exists because the change is upon us with really tangible implications of the 20 percent that have made you successful to date will not be the 20 percent that you’ll need tomorrow.

Roger Dooley: Mm-hmm (affirmative). Well, the fundamental concept of Topple is that businesses need to think about ecosystems rather than this sort of single-firm relationship or concept that they used before for playing their strategy. They can’t just look at their customers and sell on. Why don’t you explain what an ecosystem is and is an ecosystem different than a platform, like is Amazon for example, are they a platform or an ecosystem or both or are they somewhat interchangeable?

Ralph Welborn: Yeah, sure so they’re not interchanges. Let me think of a couple of examples of that. So, first of all, one of the things that we’re seeing in our environment is that, and we all know this, we’ve all seen this, that our industry boundaries are blurring together.

And one of the reasons again that so many people are struggling, they’re running the Red Queen race is that we’ve been trained in general, to look at our customers a certain way. We deliver products and services to them and our strategy’s often based on how can we deliver more or variance of the products and service that we currently have to them from an industry point of view.

And yet, as industry’s blur and as the capabilities we need come from outside our industry, that challenges how we look upon, how do we grow, how do we engage with our customers, for example.

Quick example here, so think of Amazon or even Tencent, Tencent is one of those explosive growth, enormous companies from China. They’re really tough to categorize, you can’t think of them, what are they? What industry are they from? Amazon engages in e-commerce, cloud computing, logistics, consumer electronics, books. Tencent provides services from social media to gaming to finance to others. These are inherently a reflection of some of these new business models, ecosystem business model, they don’t have any clear industry borders.

And that’s what we’re starting to see more. Think about two years ago, there is the annual conference of the automobile executives in Detroit. And every CEO of the partners, the main suppliers, and also the large company said, “Hey, we’re no longer an automobile company, we’re now a mobility company.” And that whole issue, people giggled quite a bit at that initially, and yet, if you take a look at it, they recognized that where their value is, how they were gonna engage with clients was gonna have to change and rest on a different set of capabilities.

So, an ecosystem point of view require you to take an ecosystem perspective, of course, by definition. But it has very big implications on how you start your strategy process. The traditional strategy process, again is, how do I grow by selling more of my products and services to them. An ecosystem point of view recognizes that number one, that across industries and across time, explosive growth has always come from tackling friction, non-consumption or market breakdown.

And from that point of view of then the new strategic question is, where is value being created or destroyed in the ecosystem in which I’m engaged and what am I gonna do about it? That very change in that question forces you to change your unit of focus from your industry and what you deliver to your customers to, what are the points of friction? Where am I gonna plant my flag on a particular point of friction to mobilize around?

And then number one, what’s my new 20 percent in order to take advantage of it like we talked about with the insurance exec. And number two, how the heck am I gonna orchestrate my partner network around solving that problem. So, that tees up the second part of your question. Ecosystem’s a hot topic of the day now, right? It’s a word that’s used in frequent in a lot of conversations right now. It’s taken up a lot of ink and a lot of air in conferences in client workshops.

But, to me, most of the discussions about ecosystem is, “hey, I need a partner more. So, who do I partner with to do stuff?” That’s not the lesson from the new growth models. The growth models in my definition of it is, how do you orchestrate the 20 percent of capabilities that add value to you? How do you orchestrate capabilities from different actors to capture that new point of value?

So, think of Amazon again. Amazon and their AWS, the Amazon Web Services, they give you their 20 percent for enabling business, is to give a cloud computing platform. What you do on it, your algorithms, your servers, your products and so on, is something you bring to the table. Together, you create a lot more value together. You can’t do one without the other. You have to be closely coupled, otherwise it’s not gonna work.

And so this whole issue of ecosystem centric value or ecosystem perspective requires you to think about how do you engage with your partners differently in servers to how you engage your customers differently. And then you asked a third question in there, is this has big implications in terms of how we market and how engage with customers. Typically again it’s, let’s define customer experience from the point of view of the products and services that we get engaged with our customers and make that process a lot smooth and a lot easier for them.

I think that’s fundamentally backwards. And I actually think it’s continuous to run the Red Queen race. If you start looking at it from the point of view are what are the points of friction that my customer have no matter what he or she wants to get done. That’s the friction to own, that’s the problem to own. So, my customer would love to be a musician, would love to engage with people from around the world, that’s the friction.

Any particular company, traditionally is, “How can I sell more of my drumsticks or more pianos to them,” or whatever else it happens to be. But if you start the particular point of friction with the customer and you say, “All right, here’s the problem we’re gonna own. What are all the capabilities we need to solve that problem?” Let’s say there are five of them. And then you look at yourself and say, “Okay, what are these capabilities? Can we deliver to the customer in new ways?”

And then, and only then, you talk about what products and services you currently have, which will certainly help you to find which products and services you could have to solve that need. That’s a different approach to how you engage with customers from an ecosystem point of view. And that’s one of the lessons we’re seeing from these explosive growth leaders.

Roger Dooley: Mm-hmm (affirmative), so, just to carry your analogy a little bit farther, say you’re a maker of symbols like Zildjian or somebody in … rather than saying, “Okay, well how can we sell more of these metal disks that sound pretty good.” You might say, “Well how can we help our customers promote themselves and perhaps create an app or a website or a video series or whatever,” that even though it’s not necessarily your previous core competency might serve the needs of your customers and build the market, am I on the right track there Ralph?

Ralph Welborn: Yeah, absolutely and then lets take that even a little bit further. So, from a drummer’s point of view, and my eldest son is a drummer, and his issue was, “Hey, I would love to jam with other people from around the world. I would love to use rhythms from other places.” So number one, sure, how do self-promote what I’m doing? Number two, how do I promote my band more effectively? But number three, how can learn from other people and is there any way I can actually engage with them in a different way?

I would love to be able to jam with a trumpet player from LA or from Ghana or from wherever it happens to be. So, the friction point then is self-promotion, got it as you mentioned. But part of that friction point is, how can I learn more? How an I engage with a trumpet player from Ghana or San Diego or wherever else? Well the capability what you need to do then perhaps is provide a digital sound studio.

Something like SoundCloud, where you guys can get on a certain place and jam together. Now, Zildjian might not, they’ll say, “Hey, that’s not my business. My business is certainly not to create a digital sound studio that people can engage with each other.” On the other hand, I would ask you the question, if the friction for the customer, and we know that there are hundreds and millions of musicians is, I would like to engage with people in a digital way, a way to engage with them.

Then you say, “Well, what are the capabilities to do that?” And if it something like a SoundCloud or digital sound studio and you take a look at … “Huh, if I engage with that and I’m branded that way and I start driving attraction and emotional commitment from my customers and tie it to me, is that not going to be through delivering that service? Pulling through more products that I happen to have?” Number one.

And number two, the more I do that, the more customers who engage, the better insight I’ll have about what they care about, who they’re engaging with, is that not a set of data that I can monetize as well, to both, perhaps as a separate revenue stream? And or, sell more of what I currently have, and, or, perhaps design other products I might need? Absolutely, and that is a coalescent that we’re seeing from these new leaders about looking at it from the point of view of what’s a problem, what are the different capabilities to solve that problem, which set of those capabilities are owned by different partners? Go partner with those guys to capture that particular point of friction. Fundamentally new way of engaging the customers.

Roger Dooley: Mm-hmm (affirmative), right. You know I think it’s probably pretty obvious folks, and I think we’ve already started to address that Ralph, but … how say, Apple can profit from an ecosystem because they control, monetize transactions that occur anywhere within that ecosystem, and so, it’s really a great thing for Apple and similarly, Amazon perhaps, and Google, maybe Facebook and some others have figured that out.

But, the vast majority of companies are relatively tiny compared to those giants. They don’t have the power to just sort of up and create an ecosystem. So, how should smaller firms or even large firms that don’t have that kind of power go about doing this?

Ralph Welborn: Yes, see the question is not, “How do I create an ecosystem?” The question is, “How do I engage within the ecosystem?” Where are the points of friction within that ecosystem and how can I make sure I can drive the most value and catalyze the behavior in a small part of the ecosystem I’m engaged with. Make it clear.

You take a look at the airline industry, the big airbuses are Boeing. We all know Boeing’s got, what is it, 9000 suppliers or so. An enormous number of suppliers, as does airbus and some of the others. And the question is, I may be a small firm as one of those 9000 players, but there’s clearly sources of value that live within that ecosystem and if I can identify what that piece is and then figure out what my 20 percent is and make my service absolutely critical for others and for that ecosystem of transportation there’s power.

For example, the whole idea of creating really effective sensor or radar technologies or the way to create integration among different sensor data, telemetry data, to serve insight in terms of where I’m flying, how I’m flying, what the logistic patterns have to be and so on. So, the point is it doesn’t matter your size to go through this process of asking the question of where are the points of friction, what are the key capabilities that I can develop to support it, is that will help you figure out where you to dock into these new ecosystems.

Roger Dooley: So, if you’re a small player you should be looking around, looking sideways, looking up, looking down, trying to figure out how you can become a more important cog in this big mechanism.

Ralph Welborn: Yeah, again, I think it’s a pretty mechanical process now. Again, there are four lessons that I’ve taken away from looking at these patterns of explosive growth. And I look at companies that aren’t just the big names, the Amazon, the Facebook, and so on but I look at startups. I’ve looked at small companies, I’ve looked at companies of all size. And there are growth leaders in all of those areas.

What’s interesting to me is that there’s a commonality to all of them in respect to industry, geography, and size. Now, of course there are variants to it, but at their core they all start with that new strategic question. They all start with where’s value being created and destroyed, what are the points of friction around which I can mobilize because what I’m seeing around me. And that requires them to not look at it from an industry point of view but what’s the point of friction to own?

Number two, it’s the give in that, what is that new 20 percent? What is that new 20 percent of capabilities that I can really own that particular piece of friction? And then it’s, how do I mobilize that? And then it’s given that, who else do I partner with or how do I partner with them in a way to share value and ship risks. And that’s what I mean by orchestrate you ecosystem.Those are the patterns that we’re seeing over and over again irrespective of size.

Roger Dooley: Mm-hmm (affirmative), yeah. You used a term that I wasn’t familiar with, total ecosystem opportunity. How easy is that to define for a given area? I think you mentioned the auto industry and I guess the auto industry has always been kind of an ecosystem hasn’t it? Where you’ve got the manufacturers, but they’ve always had a big supply chain on one end and then a captive dealer network on the other where they’re sort of symbiotic.

Neither of the dealers nor the automakers could rally survive without each other, at least with the current business model. One might argue that maybe different structure or lack of dealers might work, but, how do you determine what the total ecosystem opportunity is?

Ralph Welborn: Yeah, you know what’s funny, I remember several years ago when I started working in this area, people would say, “This is only for the people who are way ahead of others, this is too complicated what are you gonna do?” But over the years is we see more and more people wrestling through this and I’ve been working on these type of new models for years now.

it’s become pretty mechanical, and so, pick on me I’m not a real industry person, not pick on it but let’s work through that issue. So, before it used to be the automobile industry and yes, they had very, very tight constraints and it’s very clear how value was allocated within it. Within the industry wall known as automobiles.

As we move though, towards the question of where is value being created and destroyed and what are the friction points that customers really have? Do they care about cars? No. What do they really care about? They really care about getting from point A to point B. Quickly, conveniently, and so on. Well, what are some of the friction points around that? And is the issue really about automobiles or is it really then, because of the friction, about transportation?

And the minute you redefine it as a transportation issue, then you say, “All right, well what are some of the big friction points or the challenges that we have in order to make getting form A to B faster, cheaper, more convenient. And so you have the …, you have the Ubers pop up, you have the Teslas pop up. And remember, Tesla is not a car company. Tesla is a battery company.

And so, batteries are applicable to any mode of transportation, whether it’s a car, it’s an airplane, it’s a spaceship, thank you SpaceX, it’s a Hyperloop, thank you the new contract that Elon Musk just signed last week to Chicago. So, it’s really interesting when you reframe it from an ecosystem point of view and look at friction points.

It’s like, we all know, when you put on a different colored lens, you may see the same object, but you’re gonna see different characteristics of that object. So, an ecosystem perspective is simply a way of getting different perspectives on something that you maybe have seen all the time and number one or number two, you may not have seen at all.

And so, there’s a phrase I use a lot, how do you make visible what is invisible? And because we’re so trained from an industry point of view, a lot of times we just don’t see things and increasingly, we know, that as boundaries blur, companies irrespective of their size, who have long commanded their growth and their revenue pools within traditional industry lines are gonna be faced with companies they never previously considered as competitors before.

And so, what I’m trying to suggest here is, there are very pragmatic way to work through this thicket. Got it, world’s changed, what do I do about it? And that’s what I’m trying to help people through with the particular focus on, I passionately believe, that this ecosystem centered model is what we’re all gonna be dealing with over the next 10 years.

Roger Dooley: Mm-hmm (affirmative), what kind of pushback do you and Sajan get on this, Ralph? Do you get CEOs who don’t believe you?

Ralph Welborn: So, less so, five years ago absolutely, absolutely. It was definitely, oh gosh, you know I can’t do this, but increasingly over the past several years, no, and here’s the reason why. This is why I’m so excited by recent data that’s come out, by the frustration people have about something’s gotta be different. Ant by the nods I get and often the laughs or grimaces I get.

When I mentioned the Red Queen, so here’s a quick example, so again five years ago, “No, thank you very much, I’m very big, I’m gonna be quite good on my own.” Oh, there’s a small company in Chicago that has 76 percent of market share in the U.S, right? Pretty nice. “Thank you very much I’m doing just fine, go away see you later.”

But now, when I talk to them, number one, they recognize that this topple rate is accelerating, they’re seeing new competitors, number 2, people are going, “Oh, man, I need to get me some of that new technology stuff, I’m gonna go chase that new shiny object, whatever it happens to be, Innovation, DX, IOT, Advanced Analytics, whatever it happens to be.” But again, if everyone’s doing it what’s gonna be different?

But then a lot of people are saying, “All right, I’m gonna do something different. I’m gonna go get me one of them digital transformation projects.” What we know, and again this is where some of the new data’s coming out because we’ve had time here is that well over 75 percent of the DX, the digital transformation efforts are not in innovation efforts, are not delivering on their commitments, are failing. And if you look at why, my argument, is because they’re not clear where to focus or how to execute. They’re not clear where to focus because industries are blurring and we don’t have frameworks for that because we’re industry bound.

We don’t know how to execute because we’re just doing stuff based on the sexy new technology as opposed to focus on the new 20 percent. So, increasingly now. When I talk with people, it’s a, “I get it, there are new ways. And you know what, I’ve been using my traditional consultants, but the irony is they’re the ones who’ve gotten me into this mess because they’re industry bound.” And there are new technologies that we can take advantage of to get predictive insight and get insight from others to do something.

So, why am I still going to people who I have always engaged with before? So, bottom line long answer for a short question is now, know, now people recognize there’s absolutely something, there are new models, there’s gotta be a different way and instead of just saying, “hey, I know there’s a lot of change.” It really is around, how do I execute differently, what are those pragmatic lessons. So people are starting to pay attention now. It’s incredibly exciting time I think.

Roger Dooley: Mm-hmm (affirmative). How is this playing out globally? You mentioned Tencent and China is being an example of something that’s a lot like an ecosystem almost in itself. How is it working in both well developed countries like those in Western Europe as well as less developed countries?

Ralph Welborn: Yeah, so I first started working on this issue 10 years ago or so, working with the Department of Defense of some really tough issues where it required, we used to call it, how do you fight a network with a network? Because no one organization could deal with some of these types of challenges that we were dealing with. It required that type of collaboration.

And then I had the fortune of, for the past 10 years, of working with both public and commercial entities. And I moved over to Africa with IBM. So, I was clocked out in the middle of an extraordinarily dynamic environment of the middle east in Africa where people were absolutely exploring with new models.

The whole question was, how do I leap frog? What are the lessons of the big explosive – or are these potential explosive growth models, what do I do differently? And so, again I had the privilege of working with some incredibly bold leaders who were willing to try new things. And I remember I was in Kenya once working with the CEO startup of a payments company. And I had just read an article in the New Yorker about climate Corp.

Now Climate Corporation is spin out from a couple of engineers from Google, who wanted to tackle. The friction was, “How do I increase the farm yield in the U.S. and they went through this exercise of, here’s the friction, here are the capabilities, how do I orchestrate these capabilities from different folks to solve this problem?

So, we were doing that with a number of our clients in different parts of the world. And it’s the same model. So, I remember calling up the CEO of Climate Corp. and saying, “Hey, we’re working on this in Kenya, give us some tips, help us.” And he did. And again, that got me really intrigued about what’s going on. Is there just something that here in the U.S. because we are the U.S. and because we have so much attention from the same set of players we go to and we look at that it’s catching us up into being blinded by what these new models are.

And so, I just happen to be in the right place at the right time outside of the U.S. for a few years. So, when I came back a few years ago, I was stunned and excited, this is what galvanized me to write the book about what’s come into these models. So, the short answer is, this is a model we are seeing all over the world, because, and it makes sense, is you think about why now, the whole issue with why now is look at the data for reason we talked about. But also, technology changes and as digitization reduces the transaction cost, the margin of cost of acquired customers to near zero for just about everybody. It just makes simple economic sense for companies to start contracting out or partnering with folks differently than we ever did before.

And that is fundamentally different than we ever had before. So, it’s a global phenomenon.

Roger Dooley: Mm-hmm (affirmative). Yeah, one of your examples was a bank partnering with a phone company, which, you know usually you wouldn’t think of them as being partners. Perhaps, you know one might use the others services or the bank might develop an app that runs on Android or iPhone or something, but why don’t you wrap up with describing that example a little bit.

Ralph Welborn: Yeah, I love that example because again … and this is example is a template for what we’re seeing around the world and in big companies here. So, the issue was they had identified a particular point of friction, namely, I need to get some payments. I’m a father of a family that can’t pay for food and it’s Tuesday until Friday. What am I gonna do?

And, one of the capabilities that was really critical that we knew we had to have, we needed to have a a mechanism by which to know where I could go buy food without having money, which is a tricky thing if you think about it. And we needed … so how do I go find people where I can buy food, number two, what medium of exchange can I use if I don’t have money?

Well, mobile phones have minutes on them, minutes are a form of currency, so, the entrepreneur here said, “Well, I don’t have the networks to know where I can go buy stuff. I certainly don’t own minutes. Both of those sets of capabilities are owned by a Telco company. So let me go partner with a Telco company.”

Well, so here’s the question, why on Earth would a large Telco company be interested in partnering with a startup? And the answer is, and it goes back, where is value being created and destroyed? The answer comes down to, every Telco on the planet is facing the same problem, namely that they have to support voice lines, but the real money comes from pushing data through the pipes.

the problem with that is the people who are getting data through the pipes, tend not to be the Telco companies. They tend to be the companies like Facebook, like Google, like others. So, there’s a gap between where the Telco makes money and where they know they need to make money, namely data.

So, in walks this entrepreneur who says, “I may help you solve that problem. I’m gonna help you solve that problem because I’m gonna be creating a service that is gonna drive people to use more data so they can buy more food for their family.” And this Telco said, “Let’s try it.”

So, here is a wonderful example where both of them got value, they both identified the flag, the friction point to put in the ground, namely, I’m gonna help a family be able to pay for food in a different way. The different capabilities from different industries, it was orchestrated around that flag and they both realized enormous value from it. That is a simple anecdote which reflects the general pattern we’re seeing over and over again.

Roger Dooley: Great, well, let me remind our listeners that we’re speaking with Ralph Welborn, co-author of the new book, Topple: The End of Firm Based Strategy and the Rise of New Models for Explosive Growth. Ralph, how can people find you and your ideas online?

Ralph Welborn: Two ways, one is that my website is WWW.CAPimpact.com and love to engage with people, so my e-mail is Ralph at capimpact.com

Roger Dooley: Great, well we will post those links and any other resources we talked about on the show notes page at RogerDooley.com/podcast. And we’ll have a text version of our conversation there too. Ralph, thanks for being the show.

Ralph Welborn: Thanks, my pleasure, talk to you later.

Roger Dooley: Thank you for joining me for this episode of the Brainfluence Podcast. To continue the decision and to find your own path to brainy success, please visit us at RogerDooley.com