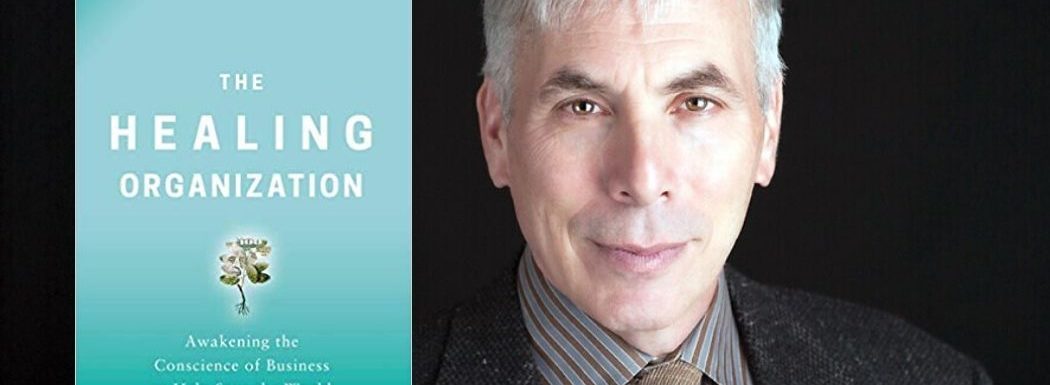

Michael J. Gelb is the world’s leading authority on the application of genius thinking to personal and organizational development. A pioneer in the fields of creative thinking, accelerated learning, and innovative leadership, Michael is the author of 16 books, including How to Think Like Leonardo Da Vinci and his latest, The Healing Organization: Awakening the Conscience of Business to Help Save the World, which was co-authored with Professor Raj Sisodia.

In this episode, we discuss whether a fundamentally different operating system for business can lead to better outcomes for customers, employees, and communities—while also providing above-average financial results. Listen in to learn how you can become a humane and positive leader, the benefits of forward-thinking, and more.

Learn how to become a positive, humane, and forward-thinking leader with @MichaelJGelb, author of THE HEALING ORGANIZATION. #greenbusiness #socialresponsibility Share on X

If you enjoy the show, please drop by iTunes and leave a review while you are feeling the love! Reviews help others discover this podcast and I greatly appreciate them!

Listen in:

Podcast: Play in new window | Download

On Today’s Episode We’ll Learn:

- How to “think better.”

- The importance of being a humane and positive leader.

- How to find the balance between self-interest and the caring of others.

- Why we feel the strong need to help others.

- The benefits of being a forward-thinking leader.

Key Resources for Michael Gelb:

- Connect with Michael Gelb: Website | Twitter | Facebook | Instagram | LinkedIn

- Amazon: The Healing Organization: Awakening the Conscience of Business to Help Save the World

- Kindle: The Healing Organization

- Audible: The Healing Organization

- Share the Love:

- If you like The Brainfluence Podcast…

- Never miss an episode by subscribing via iTunes, Stitcher or by RSS

- Help improve the show by leaving a Rating & Review in iTunes (Here’s How)

- Join the discussion for this episode in the comments section below

- Full Episode Transcript:

- Welcome to Brainfluence, where author and international keynote speaker Roger Dooley has weekly conversations with thought leaders and world class experts. Every episode shows you how to improve your business with advice based on science or data.

Roger’s new book, Friction, is published by McGraw Hill and is now available at Amazon, Barnes & Noble, and bookstores everywhere. Dr Robert Cialdini described the book as, “Blinding insight,” and Nobel winner Dr. Richard Claimer said, “Reading Friction will arm any manager with a mental can of WD40.”To learn more, go to RogerDooley.com/Friction, or just visit the book seller of your choice.

Now, here’s Roger.

Roger Dooley: Welcome to Brainfluence. I am Roger Dooley.

Today we’re going to explore an interesting topic, whether a fundamentally different operating system for business can lead to better outcomes for customers, employees, and communities, and at the same time, above average financial results.

And this isn’t an entirely new theme. While back, Tom Peters was on the show, and he’s a guy who’s had visionary insights about business for decades, and he made the point that maximizing shareholder value was not a fiduciary duty of businesses, or at least not their primary one. And it does not trump focusing on other stakeholder groups. And I think for a lot of businesses, that’s sort of a revolutionary concept where you often hear, “Well, we’ve got to close those factories because it will yield maximum shareholder value.”So we’ll look at that question a little bit. And in fact, Tom wrote the foreword to the book we’re going to be discussing today, so I think he’s sympathetic to it. And even better, Tom starts by saying that from the moment this book releases, it will be a classic, and it has now released, so apparently it is a classic. That’s high praise from a very smart guy. And now, before we get going, I’m going to add that this isn’t some kind of new-age, feel-good philosophy. It’s a way not just to improve lives, but to make businesses successful. Our guest is Michael Gelb, coauthor of The Healing Organization, and I will let him explain who he is.

Michael Gelb: Thank you so much. Well, I am the author of 16 books, The Healing Organization: Awakening the Conscience of Business to Help Save the World, coauthored with my good friend, professor Raj Sisodia, who’s a business school professor and the cofounder of the conscious capitalism movement. And people say to me, “Well, wait a minute. You’ve written these 15 other books, How to Think Like Leonardo da Vinci, Innovate Like Edison, Discover Your Genius. Why have you shifted into writing about the big-picture framework of capitalism and how it can become more humane and creative and a positive force for good in the world?” But what those people may not realize is that all of my other books are the curriculum for what you need to learn as a leader if you’re actually going to make this big-picture vision come true. So I finally laid out the vision, but I’ve been operating within that vision of trying to leverage the power of business to be a force for healing and goodness in society from the very beginning of my career, which was about 41 years ago.

Roger Dooley: Yeah. So, Michael, I read the one book that you mentioned, How to Think Like Leonardo da Vinci. He’s actually a favorite of mine. He’s in my Friction book. Not everybody knows it, but da Vinci conducted the earliest experiments to define the force of friction and even calculated what we call today the coefficient of friction. Unfortunately, this really sophisticated and amazing work was lost for centuries in his encrypted notebooks, but it was just a couple of hundred years later, finally, some other scientists did publish the work. But before we get into The Healing Organization, what’s one quick takeaway from the da Vinci book that you think might help our listeners think better?

Michael Gelb: Well, Leonardo da Vinci invented the parachute before anybody could fly. That is thinking ahead, and it’s predicated on seven principles that I define in How to Think Like Leonardo da Vinci, based on what he wrote in his notebooks. In other words, his notebooks contain specific advice to his students. So I thought, well, what’s he actually trying to teach us, and how can I translate it into contemporary language? And the very first principle is curiosita. It is our birthright of insatiable curiosity, and what we call genius, really, is a function of maintaining and strengthening that curiosity as we get older. So there are all sorts of wonderful ways to do that. And really, my new book is a function of my own curiosity about the question, how can we rethink the way we do business in order to solve many of our most important issues?

Roger Dooley: Yeah. So, Michael, you and Raj called writing this book a sacred undertaking. I don’t think I’ve ever seen that in the intro to a business book before. Were you worried that saying that might be off putting to some readers?

Michael Gelb: Well, no. No.

Roger Dooley: Okay, good then. Or if they are, they’re not the right readers for the book perhaps.

Michael Gelb: I mean, I think we’re all in a time when we’re changing habitual ways of thinking. And one of the ways that people think that’s a habitual and I think is outdated is the distinction between the sacred and the profane. And it also relates to another distinction that I think is really dangerous and outdated. And that is the distinction between so-called work and so-called life. People talk about work-life balance as though, well, you’re going to go to work and then that’ll be done and then you’ll have your life back. And that creates a lot of harm to individuals. But I also think it’s predicated on a notion of business as a kind of mercenary activity needed in order to fuel something called your life.

And in The Healing Organization, we profile 25 companies in-depth where people love going to work, where their life and their work are integrated, where their purpose and their passion and their vision and their values are expressed, not just when they go to a church or synagogue or mosque, not just in their community groups, not just in their ways of dealing with their families and their children and their loved ones, but in their everyday workplace. And, yeah, it’s true that we previously didn’t really know that this was possible and we didn’t know that operating in this way will yield more profitability. So once that, and we make a pretty compelling case for it, why would you do anything else?

Roger Dooley: Well, I guess maybe because it seems like sort of traditional business behavior or sometimes even bad behavior really works for a long time in businesses. I know you talk about some businesses in Good to Great by Jim Collins, which a wild bestseller. Circuit City, Wells Fargo, Fannie Mae, eventually they all had their comeuppance, but in some cases they had a really long run of success by implying not necessarily always unethical practices. Wells Fargo is perhaps an extreme example of sort of management incentives gone wrong, but it seems like it works. It would be the simple answer that managers come in, they manage the numbers, and shareholders are happy, everybody gets raises, and what’s not to like?

Michael Gelb: Well, what’s not to like is that Philip Morris, one of those companies, probably indirectly or even directly responsible for vast costs in terms of major suffering to millions of people. That’s not accounted for in a system that looks only at shareholder value, which is why, I mean, this is even the business roundtable’s come along in this regard. We’re realizing that, yeah, that if you just happen to be a shareholder in one of those companies and you’re just looking at your portfolio return, it looked like a pretty good thing. And look, don’t get me wrong, I think Jim Collins is a brilliant guy and he’s done a lot of wonderful work. But if you look at Raj, my coauthor’s book, Firms of Endearment, companies that have for many years been looking at the wellbeing of all their stakeholders, not just their shareholders, and have done so consistently, the Firms Endearment Companies outperform the Good to Great companies financially, as well as creating all sorts of positive benefits for all their stakeholders, not just their shareholders. So once again, I say once you know this is possible, why wouldn’t you do it?

Roger Dooley: Good point. And I think that what you’re seeing in some ways is what’s driving part of the current political ferment. We’ve got people at various ends of the socialism spectrum in the United States, which is pretty much unheard of historically, at least for quite a few years. But they’re advocating doing something other than capitalism. I mean, do you think this is in part what’s driving it? When businesses are operating to satisfy shareholders, and often, in relatively ethical ways, I mean, not lying or cheating or stealing. But when that’s their primary focus, they end up exacting other costs on society that simply don’t work for everyone.

Michael Gelb: I’m glad you brought this up because part of what we see The Healing Organization as a new model that can bring together left and right and help us really operate according to shared values. And to be more specific, the right often posits the importance of unfettered capitalism because there’s an underlying value that says … and it’s a correct value in my view, it’s one that I hold. It’s based on Adam Smith and The Wealth of Nations. And it is the idea that freedom leads to prosperity, and even unconscious capitalism has yielded incredible benefits for humanity. I mean, it’s probably the greatest. Capitalism is probably the greatest idea that humanity’s ever come up with in practical terms. In the last 250 years, the level of standard of living around the world has continuously improve. We have quarter million people are being lifted out of poverty today in India, in China, by the spread of capitalism. And the rate of extreme poverty, most of humanity lived in extreme poverty 250 years ago, and now the statistics are reversing from the way it was 250 years ago.

So and this is all due to to capitalism, but we’ve reached this inflection point because what got us here won’t get us to the next stage of our prosperity, abundance, and wellness as a society because a lot of that first 250 years, first of all, was predicated on the idea that the Earth’s resources were unlimited, and that notion has obviously come into question. The other thing that’s missing, though, is that as powerful as the Wealth of Nations is, and as important as it is to share the value, which we do, that freedom leads to prosperity. Adam Smith wrote another book, and it’s called The Theory of Moral Sentiments. It was 17 years before the Wealth of Nations, and it’s the other critical aspect that he saw as essential to the functioning of capitalism. And that was it had to be based on empathy and concern for all of society, that it had to be caring.

So these two dynamics, self-interest and caring for others, the balance between those two modalities is what creates the healthiest form of capitalism. And the doctrine of focusing only on shareholder return, really, propagated largely by Milton Friedman who was trying to do his best. I mean, he wasn’t a bad guy either, but they forgot the theory of moral sentiments. We’ve got to bring it back and what we’re saying, people on the left, the objection we get from the left is, “Well, all business is bad, and it’s exploitive, and it’s destroying the planet. It’s ruining people’s lives.” Well, no, not true. Don’t throw out the proverbial baby with the bathwater. What if we integrated the real books that gave birth to capitalism and remembered to bring back the theory of moral sentiments and marry it with the Wealth of Nations. As Raj, my coauthor, likes to say, “Capitalism had a mother and a father and they were both Adam Smith.”

Roger Dooley: Yeah. Well, really, some might say he was the first behavioral economist. It’s like a behavioral economics wasn’t invented just in the last few decades. But really, I think what you’re saying, and particularly with Milton Friedman, is sort of when you think of economics in quantitative terms, what do businesses do? Well, okay, they maximize value for shareholders in the same way that individuals supposedly maximized personal utility. And of course, we now know that people are not robots, and they don’t always behave rationally. But I think, when you’re trying to fit everything into nice, neat equations, that maximizing shareholder value or maximizing profits, it kind of makes sense. I mean, there’s sort of some logic to it, if nothing else, and looking at labor as yet another input like material that also sort of fits the equations nicely, but again, does not create the ultimate environment that’s going to work best.

Michael Gelb: Yeah. Well, let’s look at it this way. We have the most prosperous nation in the history of the world as we know it, the United States of America. And yet, we lead the world in obesity, in opioid addiction, in gunning down our school children, and in suicide rates, we’re up 30% in the last 20 years. About 60% of Americans are technically insolvent. They’re bankrupt. Their liabilities are greater than their assets. This is not sustainable, and Adam Smith said so. So socialists go running and screaming and say, “Let’s have government take over everything and shut down capitalism. Look at how evil and bad it is.” But the other side of this is, 40 or 50% of people are doing really well and prosperous and probably more prosperous. There’s more wealth and opportunity than ever before. So in the book we talk about Dickens, it’s the best of times, it’s the worst of times.

And those of us who are blessed to be prospering, doing really well, it’s quite natural that when you are experiencing abundance, there is something in our human nature that wants to help others that wants to make … what about those other 50 or 60%? I mean, let’s have compassion and let’s figure out, what if there was a way that we could change the way we do business that doesn’t cost … we don’t have to give away all our money or stop being successful ourselves. There’s more than enough to go around. But what if we shifted our way of doing business so it was more inclusive and looked after and helped and empowered people who currently aren’t benefiting from the way things are structured. And the stories we tell in the book are stories of people who are doing this, and what what we find is these companies who take on these challenges, who actually create net positive effects on the environment, who treat their … I’ll give you an example. At HEB, the grocery chain down in Texas and-

Roger Dooley: Yeah. I’ll interrupt you, Michael. I am in Austin, Texas. And not only am I a frequent customer of HEBs, I’ve actually written about them in Forbes, an article called The Smartest Supermarket You Never Heard Of. So I was delighted to read the story that you’ve gotten there. My focus was on their marketing and to some degree the consumer psychology that use, either knowingly or intuitively, and I think they do a brilliant job in that, but what’s your take on HEB?

Michael Gelb: They’re geniuses. First of all, Charles Butt is in the giving pledge, so he’s one of the billionaires who has committed to give half or more of his wealth to charitable causes. But more than that, he also earns his money in a way that heals communities, heals the people that work there, is beloved by customers. And that’s even before there’s some kind of natural disaster where HEB sends out water, sends out disaster relief, does amazing service to their extended communities. Charles Butt told his CEO, “Pay our people as much as you can, not as little as you can.” So HEB, it actually stands for Herbert Edward Butt, who was the son of Florence who started the company, Charles’s grandmother. Amazing visionary, ethical, moral, truly Christian, giving, loving, fabulous, great business woman who gave birth to this incredible business with a core foundation of wanting to heal communities, take care of all stakeholders and create tremendous prosperity.

So people who work for HEB, to them HEB stands for Here Everything’s Better. What happens when companies are predicated on this higher purpose on this sense of caring? People love them. You get more passion, more engagement. People love working there. Southwest Airlines is a classic example. People love these companies. They want to do business with them. And the result is they’re more profitable and they make the world a better place. So again, it’s just we have to understand that that’s possible because a lot of us grew up with this idea that it’s only a dog eat dog world, that we’re in a rat race, and we didn’t learn that the winner of the rat race is still a rat.

Roger Dooley: Right. And for our listeners who don’t know HEB, of the 50 States in the United States, they are only found in Texas. They have a few stores in Mexico as well. And they are ranked when people have done customer delight surveys, they are right up there at the very top of them with a few other stores like Trader Joe’s and Wegmans, who also have a great employee cultures too from what I understand. And their stores are just a lot of fun to go to. I mean, I generally don’t seek out a grocery shopping opportunities, but HEB, sometimes I’ll make an exception because it’s just fun walking through their stores that people are lively and engaged. It’s a good experience. So one company that you mentioned and not necessarily in the most positive way is 3G Capital. I’m guessing quite a few of our listeners don’t know who 3G Capital is, and I have sort of a small awareness of them, but the brands they own are very familiar. I explained a little bit about what they do and what the problem might be with their approach.

Michael Gelb: Well, what they do is they take over companies, they suck the life out of them, they cut everything they can, they eviscerate them and sell off the body parts. So and we contrast them with a healing organization called Barry Waymiller, which was started by this guy Bob Chapman. And Bob Chapman … but when we wrote the book, he may have watched some more companies since we wrote the book. But when we wrote the book, he had acquired 108 different companies, and he hasn’t sold one of them. Instead, what he does is to revitalize them through what he calls truly human leadership. And Bob says, “We measure success by the way we touch the lives of people.”

Now bear in mind that these are not glamorous companies. They started out mostly Midwestern type companies in the kinds of industries that were being transferred off to Brazil or China because everything could be done cheaper. But Bob went into these communities, bought these companies, treated people really well, rebuilt these businesses, hasn’t sold one of them, and overall he’s average 17% profit a year. So he’s turned them into profitable enterprises in a very successful way. But it’s like it’s one of the characteristics of all of the companies that we profile is people love them, and they love them because there’s a genuine quality of caring. It’s not fake. It’s not just, “Well, we’ll have a corporate social responsibility effort to try to help mitigate some of the problems that we caused.”

Bob is like a minister. Part of how he got the idea for this is he was in church and he said, “I’m running these businesses. And I listened to my pastor, and he gives these inspirational speeches, and he uplifts people, but he only has them for an hour a week at church on Sunday.” He said, “The people who work in my companies, they’re there for for 40 hours a week or more. I’ve got to do something to uplift their lives and uplift these communities.” So if 3G Capital is looking at your company, people are terrified because they know jobs will be lost, lives will be ruined and parts will be sold off. When Bob Chapman is looking at your company, people say, “Hallelujah.”

Roger Dooley: And 3G owned some very familiar brands, like a Budweiser and all the AB InBev brands that are really kind of beloved traditional brands in many cases. But some of the, well, not only might they be imperil, some of those are a bit imperil, at least from the standpoint of declining sales and profitability.

Michael Gelb: Well, that’s just the thing is, short term, you can make it look good on the numbers if you get out fast enough, but if you stick around after you lose all your good people, it doesn’t bode that well. And that’s the kind of thing we’re seeing. That’s why, I don’t have the latest numbers on 3Gs acquisitions, but their performance has fallen off significantly. And that’s often the case with these corporate raiders.

If you happen to time your investment well enough when they’re squeezing out the short-term profit, if you can get out before then, once again your portfolio might look good, but what’s the human cost? What’s the cost to society? What’s the cost to those families? And what if, instead of ruining people’s lives, what if instead of scorching the earth, what if instead of looking at only one narrow dimension of success, we broadened our definition of success to include the welfare of all of our stakeholders? And what if we could do that in a way that was more sustainably profitable? We make the case for this 25 stories and there’re more, we could’ve put in more, but we were only allowed a certain number of words in the book.

Roger Dooley: Yeah. Well, one story that that reminds me of is DTE Energy, the Detroit power company. And that story kind of echoed something that we’ve talked about here before, and that is when a company’s in trouble, the common response is for new management to come in and reduce head count, maybe replace other key people to affect a turnaround. But that is not always the best strategy or rarely is the best strategy, as we’ve discussed here. At DTE, the new CEO rejected layoffs and focused on transparency, explaining to the existing people what the problem was and how they could help. What else did he do?

Michael Gelb: Well, we were at, last week, Raj and I were co-chairing the Conscious Capitalism CEO Summit down in Austin, and we were lucky enough to have Jerry Anderson as one of our speakers. And it’s just such a beautiful story, because in his moment of truth, he had taken over DT Energy and he wasn’t particularly a visionary. He was just a solid all-American business guy focused on the numbers, as he was trained to be. And he was also very honest person and he just looked at the state of the company when he took over, I think it was back in 2004, 2005, and he asked, he said, “Are we a good company?” He said, “Well, our returns are not that great financially and our customers don’t really love us and our employees aren’t really too thrilled about being here based on all our surveys.” He said, “I have to honestly say we’re not really as good a company as we could be.”

So he got really curious, how can we become a really good company? And he got involved in continuous improvement. And the first principle of continuous improvement is value your people. Value your people. So he put together a task force on how do we really take care of our people and that’ll help us be a better company. And he just had launched this initiative when the financial crash happened, and Detroit was at the epicenter of the crash, people were losing jobs. The community went bankrupt, effectively, and DTE was on the verge of becoming what their controller said might be a junk utility. So the financial people, the controller, the CFO went to Jerry Anderson said, “We’ve got to lay off a significant percentage of the workforce if we’re going to make our numbers.”

So Jerry had a moment of conscience. The subtitle of the book is Awakening the Conscience of Business to Help Save the World. And in this moment, he said, “Fear says lay these people off,” he said, “but I just made a commitment to value people. How can I be true to what I’ve been promising people if we hit a crisis and the first lever I pull is to get rid of those people?” So he did something extraordinary. He called an all company meeting with thousands of people and he just leveled with them. He said, “Look, I’m in this terrible quandary because I just made this commitment, but here’s what our finance people are telling me.” He said, “So here’s the pledge I want to make to you.” He said, “Layoffs will be the absolute last lever I will pull. I’ll do whatever it takes to avoid that.” He said, “But in order for that to happen, I’m going to need something extraordinary from all of you. I’m going to need you all to work with more energy, more commitment, more engagement, more creativity than ever before.”

I mean, people sensed that he was for real, so the story is good. Jerry told the story and he’s such a down to earth, unpretentious guy telling the story. He said the numbers are coming in every month and he’s going over them with his controller and he’s looking at them and he doesn’t believe them because they’re too good. And he says, “How are we beating all of our numbers? How are we …?” He said, “Check your model, go back and redo these numbers. We can’t be doing this well.” But what happened was they tapped into this phenomenal resource of human creativity, engagement and caring because they got that he genuinely cared and was going to go out of his way to support them. And they responded by just transforming this company into a truly great company.

So within a year, not only were they out of danger, they were healthier than they had been in years. So Jerry was going around and having these breakfasts with different workers from DTE, different locations, and just to talk to them and get to know them and keep in touch with what people are thinking and feeling. And he goes to one of these breakfasts and a woman comes up to me and says, “I never got the chance to thank you for saving this company and saving my job.” She said, “When the crash hit, my husband worked for another company. He was instantly fired. And if I had lost my job, I don’t know what we would’ve done. We would’ve lost our home. We’d probably be homeless.” She said, “but by you keeping us together and giving us this opportunity, you’ve saved our family.” And she said, “I’ll be forever grateful to you.”

But then, and this is the point we were talking about earlier, but then she said to him, “But now that we’re doing well, we look around and we see so many other people in our community who are suffering, who are hurting. What can we, DTE, do to help them?” And she inspired Jerry and a whole movement at DTE to put together a consortium of companies in Detroit to address many of the most egregious issues in that very challenged community. And DTE has played a tremendous role i all sorts of positive initiatives to heal the rest of the community. And this is what Adam Smith said would happened. He said, “When we experience abundance, when we experience success, it’s a natural human impulse towards caring and community because,” he said, “we recognize that we’re part of an expanded community and we want to live in a prosperous, abundant, happy, and healthy community.”

A community which we now live in an America where more than half the people are bankrupt, where significant numbers people are committing suicide and suffering from anxiety and depression, are addicted to opioids and are obese and are shooting children. This is not okay. I mean, how can we not care about that, especially if we can leverage the power of business to help solve these problems? So that’s what all these companies do. That’s what DTE did. That’s what AGB does. And so then, in the last part of the book, we look at how can you help make your enterprise more like this and that’s every one of us can take steps to make whatever we do more healing instead of hurting.

Roger Dooley: Yeah. That DTE story is almost a mirror of a past guest, a fellow named Bob Bethel, who was a turnaround specialist. And he’s the guy that banks brought in when they were about to lose the money they loaned companies to try and salvage something, and the exact same approach, having all hands meeting. These companies were not as big as the one you’re describing. They’re typically somewhat smaller companies but not necessarily tiny, but an all hands meeting where often people were hearing for the time how serious the problem was and also for the first time being asked to find ways that they could contribute to making it better because they’re the ones who know where the problems are, where the inefficiencies are and so on. And in the past, that sort of management employee divide just sort of kept him, “Okay, just do what we tell you.” And obviously that wasn’t working. But anyway, we are about out of time. Let me remind our listeners that today we are speaking with Michael Gelb, coauthor of The Healing Organization: Awakening the Conscience of Business to Save the World. Michael, where can people find you and your ideas?

Michael Gelb: Thanks for asking. The best place is michaelgelb.com. That’s G-E-L-B, michaelgelb.com. And they can also read excerpts of the new book at healingorganizations.com.

Roger Dooley: Great. Well, we will link to those two places and to any other resources we spoke about on the show notes page at rogerdooley.com/podcast, and we will have a handy text version of our conversation there as well. Michael, thanks for being on the show.

Michael Gelb: Great to be with you. Thank you.

Thank you for tuning into this episode of Brainfluence. To find more episodes like this one, and to access all of Roger’s online writing and resources, the best starting point is RogerDooley.com.

And remember, Roger’s new book, Friction, is now available at Amazon, Barnes and Noble, and book sellers everywhere. Bestselling author Dan Pink calls it, “An important read,” and Wharton Professor Dr. Joana Berger said, “You’ll understand Friction’s power and how to harness it.”

For more information or for links to Amazon and other sellers, go to RogerDooley.com/Friction.