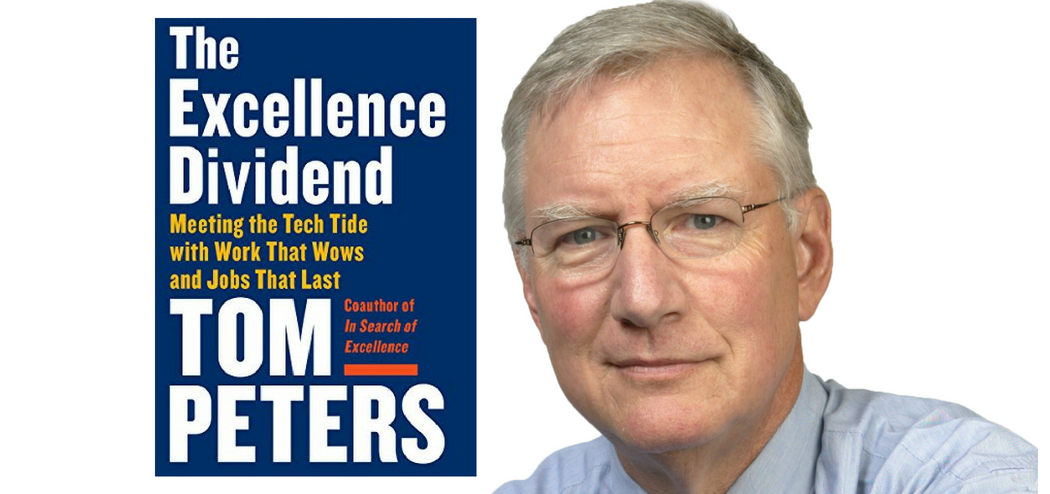

Tom Peters co-authored a book that changed the way the world does business, and which is often called the best business book ever. In addition to the massively successful In Search of Excellence, Tom has authored or co-authored seventeen other books, including his latest, The Excellence Dividend: Meeting the Tech Tide with Work that Wows and Jobs that Last.

Still breaking new ground in management thought leadership thirty-five years after In Search of Excellence, Tom received the Thinkers50 Lifetime Achievement Award in November of 2017. He joins the show today to discuss how too many companies get it wrong when it comes to effective business practices and finding the proper focus. Listen in to hear what Tom says company leaders must understand, his unexpected stance on maximizing shareholder value, and more.

If you enjoy the show, please drop by iTunes and leave a review while you are feeling the love! Reviews help others discover this podcast and I greatly appreciate them!

Listen in:

Podcast: Play in new window | Download

On Today’s Episode We’ll Learn:

- Why Tom is frustrated with so many businesses.

- What he calls one of our many sins as a society.

- Why companies should not focus on maximizing shareholder value.

- The focus that will naturally lead to giving shareholders great returns.

- What “lowercase d” diversity is and how it benefits the workplace.

- The big thing company leaders need to understand.

- Why Tom guarantees that readers won’t find anything new in his books—and why that’s a good thing.

- What he says everybody ought to have in his/her head.

Key Resources for Tom Peters:

-

- Connect with Tom Peters: Website | LinkedIn | Twitter | Facebook | Google+

- Amazon: The Excellence Dividend

- Kindle: The Excellence Dividend

- Audible: The Excellence Dividend

- Amazon: In Search of Excellence

- Excellence in Troubled Times with Tom Peters

Share the Love:

If you like The Brainfluence Podcast…

- Never miss an episode by subscribing via iTunes, Stitcher or by RSS

- Help improve the show by leaving a Rating & Review in iTunes (Here’s How)

- Join the discussion for this episode in the comments section below

Full Episode Transcript:

Welcome to The Brainfluence Podcast, with Roger Dooley, author, speaker, and educator on neuromarketing and the psychology of persuasion. Every week, we talk with thought leaders that will help you improve your influence with factual evidence and concrete research. Introducing your host, Roger Dooley.

Roger Dooley: Welcome to the Brainfluence podcast. I’m Roger Dooley. I’m super excited about this week’s guest. I’ve been a fan of his work since my corporate days back in the 1980s, which kind of dates both of us, but it shows how long he’s been influencing business thinking.

Roger Dooley: His first book was In Search of Excellence, coauthored with Bob Waterman and published in 1982. The initial print run was just 5,000 copies, but a year later, it had sold a million. Within a few more years, that total was up to three million, and as recently as 2006, it was the most help business book in libraries across the country.

Roger Dooley: Other bestsellers, either authored or coauthored by our guest, are A Passion for Excellence, Thriving on Chaos, and In Search of Wow, and, of course, he is Tom Peters. And his newest book is The Excellence Dividend. Tom, welcome to the show.

Tom Peters: Thank you, Roger. I am absolutely delighted to be here and to give personal information away about you. You did a tweet with a photograph with a picture of my new book with many, many tabs in it, and so in this public setting, I want to take the opportunity to say you made my day, week, and month. I photographed it, and it’s on my desk.

Roger Dooley: Well, thank you, Tom. And not every book I read gets quite as many tabs. Trust me on that.

Roger Dooley: Tom, I mentioned that I’ve been a fan of In Search of Excellence, and going back to the very early days … So you were at McKinsey then, and that was part of a consulting project or a research project that you worked on for them. And I gather at the time, your conclusion that a company’s culture was the key driver of success wasn’t all that big of a hit within McKinsey.

Tom Peters: Yeah, that’s a gross understatement. It was the late ’70s, early ’80s, and basically, the world … In the ’90s and the Jack Welch year, everything was maximize shareholder value. In the ’70s and ’80s, everything was strategy, strategy, strategy. And the organization stuff and the people stuff were only Chapter 9 in a 10-chapter book.

Tom Peters: Now what happened, and I’m not going to drag this out forever … The context was that the US had been not only at the top of the heap, but kind of the only heap in the post-World War II era, and suddenly in the ’70s, the Japanese came calling. And they particularly came calling in Detroit. Steel is one thing, but when you hit us in the car industry, you’re really hitting us below the belt.

Tom Peters: In Search of Excellence was second, in a way, and first on my list is actually a single article, and it was in the Harvard Business Review, written by Bob Hayes and, I think, Bill Abernathy. And it was called Managing Our Way to Economic Decline. And basically, the thesis of the book was, too much attention on finance and marketing, not enough attention on people and quality. And in a way, we were just picking up the thread on that. We identified some companies, we went around to those companies, and the culture story required no brains on our part. Basically we got hit over the head by it, and saw it, and were just in awe of what we were seeing in places like a much smaller Hewlett-Packard, Johnson & Johnson, 3M and so on.

Roger Dooley: So you ended up parting ways with McKinsey before the book even came out. I read it in an almost contemporary Washington Post article that McKinsey had agreed to split the royalties with you, and I’m kind of imagining you going home, if you were married at the time, telling your wife, “Hey, bad news, I’m out of a job. But the good news is that they’re going to be splitting the royalties on this book that’s coming out with me.” And her asking, “Well, okay. How many copies is the initial print run? And how many copies does a typical business book sell?” At the time, did it seem like the worst exist package ever?

Tom Peters: Oh, absolutely. My memory is, I paid $50,000, which … McKinsey partner pay, and I was a partner at the time, was incredibly high by normal standards, but it was about $100,000 a year. And I paid $50,000 for half the royalties, and as you said, the print run … I had 3,000, 5,000, something like that. And so it was the short end of the stick. I will have to say, in all honesty, which shall not be part of this discussion, is I’d gotten pretty wrapped up in some things and if I’d been McKinsey, I would’ve fired me too.

Roger Dooley: So at the time it came out, I was a brand new, actually, planning director for a Fortune 1000 company. So I was one of those strategic planners that you were just talking about. Very, very young at the time, at least for that kind of role. It was really, the book was a topic of discussion. We also went the strategy route. The CEO brought in Boston Consulting Group and they did their infamous matrix analysis where, during that, we had mostly cash cows and dogs and … Big surprise there, but kind of the way it was.

Roger Dooley: But definitely remember that was kind of interesting at the time. There was a director of research and development who was about my age, compared to most of the management that were sort of the previous generation. And we even turned some of the ideas into little memes for our company, like a bias for doing nothing instead of a bias for action, and ready, aim, shoot yourself in the foot. It was an interesting experience, we ended up actually departing the big company and starting our own entrepreneurial venture together that had a really pretty good 13 year run.

Tom Peters: Yeah. But Bob and I were emphasizing the culture stuff and so on, as you said. But the first thing that was published, pre-Excellence, was called the 7-S Model. And what we said is, there are hard S’s and soft S’s. There is structure, strategy, systems, and they are terribly important. But equally important is the skill stuff, the culture stuff, which we … I’ve forgotten the word that we used, but there were four soft S’s and three hard S’s, and we said the real key is all seven and keeping them in balance. So we weren’t total idiots. We were suggesting that there was some stuff that needed to be near or at the top, but we weren’t idiots. Bob and I, among other things, were both engineers. I was a civil engineer, he was a mining engineer, believe it or not, from the University of Colorado.

Roger Dooley: Good place to go for mining. But coincidentally, I’m an engineer myself. I’m a chem E, so I haven’t of course done that in many, many years. But I think it’s a great background for anything. It kind of teaches you to take the world as it is. And engineers, when they’re actually doing their profession, can’t just operate on assumptions or wishes. Stuff pretty much, if you build, it’s gotta stand up.

Tom Peters: Right. It’s funny, because I get in trouble with it on my Twitter account to this day, is when people talk about completely hierarchy-free organizations. My comment, which is in civil engineering, is I prefer not to drive across the bridge that was built by an organization that didn’t have a project manager who was responsible at the end of the day. And I’m very serious about that.

Roger Dooley: Yeah, well, for sure. Of course, the low bidder did get the deal. So …

Tom Peters: The low bidder. What was that, was the famous-

Roger Dooley: That was one of the astronauts, I think-

Tom Peters: … circling the Earth in a satellite or whatever, one of the spaceships that we sent up early on. He said something about, “I do remember that every single piece of this was supplied by the low-cost bidder.”

Roger Dooley: Yeah. I want to get to the book, but I just want to bring up Twitter for one minute, Tom. You interact with people a lot there, and I’ll put in a plug right now for any of our listeners who aren’t following you already. Your Twitter handle is @Tom_Peters, and if I could follow just one business expert, I think it would be you. You do such a great job there of not only dispensing wisdom, but really mixing it up with people, sometimes arguing a bit with somebody who disagrees, and this takes some time. I take it you like that medium?

Tom Peters: Yeah, I think it’s … I must say, I think it’s just simply raw fun, and I learned way back in the old days, before this year, that in reality, you can make a coherent statement that is grammatically correct with 140 characters including spaces. 280 makes it a lot easier, perhaps, but it’s a great discipline, I think, to, among other things … And it’s a very interesting group of people to talk with.

Tom Peters: And one of the chapters in the new book on innovation, the section only has two chapters, and one of the chapters is diversity. And my definition of diversity, and I’m completely in favor of gender balance and various other things of a social nature, but I call it lowercase-D diversity, by which I mean, diversity on every dimension known to humankind. I want to team with people who went to Harvard and I want to team with people who dropped out of school after high school, and as I’ve said, taking it to an extreme, short people, tall people, bald people, people with long hair. But just surround yourself with different people, because it is a crazy time, and there’s a lot of same-same that goes on in organizations. And I don’t think it’s good for your intellect or your spirit, but I think it’s also bad business practice. We need to be stimulated all the time, particularly in 2018.

Roger Dooley: Well, there’s a ton of research that shows diverse in various ways, generally come up with better solutions to problems than teams that lack that diversity of input.

Tom Peters: Absolutely. There’s a book that I quoted, Scott Page, maybe is his name. And you know this, because this is your specialty. It is just bizarre, a team of randomly selected people, there is some kind of a benchmark to get on the team, randomly selected people does a better job at prediction in foreign affairs activity than a group of the very best and best-trained, with great CVs, experts. And just, it’s very, very powerful stuff. And it’s unequivocal. Again, as you know because you’re a research fanatic, the research is hard as a rock on that.

Roger Dooley: Yeah. Well, let’s move on to the Excellence Dividend, Tom, and I really enjoyed the book. Read the entire thing, and it runs a pretty lengthy 460 pages. And something that I’ve seen a few reviewers criticize is that it’s got a lot of big type, bold type, big bold type, exclamation points, and even a few cuss words. You can’t read the book, at least I couldn’t, without getting a sense that you are really somewhat frustrated that so many businesses are still doing things the wrong way after the answers have been out there for everybody to see for so long. I even like the fact that there’s one chapter titled One More (Damn) Time Putting People First, and then you go on from there and say … But your private title for the chapter was The Batshit Chapter. Am I right in sensing this level of frustration?

Tom Peters: Oh, there is no question. You are right on the money. I gave a talk at Fidelity, the investment people, the other day, and I said it just absolutely bugs me. I said, “I know I’m surrounded in this room by quants who are 10 times smarter about what they’re up to than I am, but the reason we screwed things up is stuff that’s pretty damn straightforward.” And again, my smart aleck term, I said, “It does not take an above-freezing IQ to understand anything that’s written in those 450 pages. It says try a lot of stuff. It says ask people, what do you think? It says, say thank you. It says, if you don’t have gender balance in a world where women buy 80% of everything, you’re an idiot.”

Tom Peters: I’ve got four quant degrees. Two in business, two in engineering. It does not require third-order differential equations. And I looked at it as a last book, and I am passionate, and I am irritated that the obvious … I wrote something that was actually an appendix to this book, but long as it is, we did do some cutting. And it was called The 34 BFOs. And the BFOs stands for Blinding Flash of the Obvious.

Tom Peters: And BFO actually came from a seminar I gave years ago to the Young Presidents’ Organization, two days long, and at the end of the two days, I was asking people, “What did you think? How did I do? What did I forget?” And so on. And there was this one guy who, I think he was the #1 Burger King franchisee, he owned south Florida. And I talked to him a lot and really got on with him. And he said, “Well, I spent two days of my life, which is no small thing,” and he said, “I didn’t learn anything new.” And when that came out in public, I wanted to shoot myself.

Tom Peters: And then he said, “But it was the best seminar I ever attended.” He said, “It was a blinding flash of the obvious. The incredibly important stuff that, in the heat of the battle, we forget to do.” And in my next book, I actually had a chapter that was titled Blinding Flash of the Obvious. So it really is. There’s nothing … I say, which is a hell of a guarantee, when I talk to people about the book, I say, “I guarantee you that you will not find anything new in this book,” which isn’t quite fair ’cause I have done my best to keep up with the technology and so on. But the basic ideas about the people stuff, the innovation stuff, the leadership stuff, they knew.

Roger Dooley: Well, I think sometimes you need those meetings. It’s kind of like a religious revival or something where there’s not really anything new in what the preacher might be saying, but he’s at least getting people fired up, hoping they take some kind of action based on that information.

Tom Peters: Oh yeah, absolutely. It’s Nancy Austin, who was co-writer of A Passion for Excellence with me back in ’85, sent me this lovely note and said, “It’s my favorite book of yours by far, including the one that I coauthored myself, because I see more of you in the book.” And you were talking about bold type and so on. There was a friend I know who used to write the management column of Financial Times. The British publication of the book came out on June the 7th, and he called the book “a cup of triple espresso,” and I was happy as a clam with that.

Roger Dooley: Yeah, I was thinking of various analogies. The firehose analogy came to mind, the old drinking from a firehose thing, but also being machine gunned by your ideas, because at times it sort of felt like that. But it’s a good thing, and I don’t think anybody would question if that’s the real you shining through, Tom.

Tom Peters: Well, for better or for worse, you’re probably right.

Roger Dooley: So if you look at big corporations, Fortune 500 or whatever group you like, what percent do you think really get it mostly right in terms of the culture and putting people first, and some of the ideas that you express in the book?

Tom Peters: Well, I’m going to answer your question after giving you a non-answer. The non-answer, which may sound not believable, is on two dimensions. I don’t care. What I’m interested in is finding, and we have been all the way back to In Search of Excellence, finding examples of people who do it right and laying it out there. And if you want to grab hold of it, fine. If you don’t, not my problem.

Tom Peters: But far more important than that in today’s environment is, if there is such a thing as management guru group, and I despise the term, but it is what it is. The Economist invented it. One of our many sins is we act as if the world was only the Fortune 500 or the FTSE 100 in the UK. And the reality is, all around the world, including the United States with our advanced economy, 80-85% of us work for so-called SMEs, the small and medium sized enterprise.

Tom Peters: if you want to know what my dream is, my dream is that The Excellence Dividend or maybe one of the earlier books is picked up by a man or woman who runs a 20-person company and really gets excited by this stuff and the customer service goes up and the people engagement goes up, and a year and a half from now, instead of a 20-person company, it’s a 35-person company. That’s my idea of the biggest of all possible wins, and indeed … And again, back to the Fortune 500, and we really emphasized this going back to In Search of Excellence, we talked to damn few CEOs. What interested me was the “CEO” of a $40 million division embedded in a $10 billion company. People who had effectively small businesses within big businesses.

Tom Peters: And when I talk about excellence, including in The Excellence Dividend, and I do it several times, I’m talking about converting a 17-person purchasing department or a 12-person training department within a sizable company into a real gem. And so those … When I get letters from people who did that with that 12-person division or department, as the case may be, or the 20-person company that became a 35-person company, that’s the definition of a grand slam home run for me.

Roger Dooley: Well, I would guess that it’s actually easier to effect change of that type in a smaller organization. If you’re a CEO of a company with divisions all over the world, with tens of thousands or hundreds of thousands of employees, trying to say, “Okay, well, we’re going to change our culture,” is not going to be quick or easy. Not that changing culture is quick or easy at any level, but-

Tom Peters: But it can be done. Now, reversing myself, there’s a culture chapter and it features, and I’m not going to read it here or anything like that ’cause I don’t even have the book next to me, but it features the IBM turnaround that was architected by the toughest guy in the world, Lou Gerstner, during the 1990s. And Lou was Mr. Strategy at McKinsey and Mr. Strategy at American Express and so on, so he took on this turnaround effort, and what he says in my chapter on culture is … He said, “I came in believing in strategy, metrics, and analysis. And what I discovered was that culture is not part of the game. Culture is the game.” And to your point, it’s darn difficult to change the culture of a multi-hundred thousand person company. But it can be done.

Roger Dooley: Well, fair enough. One of your ideas you focus on a little bit in the book that really gave me more pause than most … A lot of the stuff was expected in certain ways, but your emphasis that the purpose of a company is not to maximize shareholder value. I know that’s not just your idea. People have written books about it. But I kind of assumed that somehow these were maybe some sort of college professors or other people without too much hands-on experience. But it surprised me to hear it coming from a business guy like you.

Roger Dooley: And I know that personally, I got the usual business school indoctrination that the shareholders always come first, although obviously a company has to satisfy its other constituents if it’s going to survive and thrive. I’m curious what your thoughts are. I guess there’s a legal argument. At least in some cases, it’s been found that shareholders do come first, if push comes to shove-

Tom Peters: My understanding, and I’m not a lawyer, is that that’s not so. There is, back to your professors, a Cornell University Law School professor whose name is Lynn Stout, and she wrote a book called The Shareholder Value Myth. And she does that thing that … Well, I won’t say I don’t understand it, but it’s beyond me. It’s loaded to the gills with legal citations, and there is fundamentally nothing in the law which requires you to maximize shareholder value. And, far more interesting to me in a way, and I’m not going to say this right, Roger, ’cause I don’t have the background, but shareholders do not own the company. Shareholders have a contract with the company which is absolutely no different than the contract that a vendor has or a labor union has or what have you. Her bottom line, relative to the law, is you can choose any purpose you want under the sun, as long as it is legal.

Tom Peters: And Welch, for god sakes, Welch who was Mr. Shareholder Value is … When I go through this section on the topic, I start with a Welch quote. And the new Welch said, “There is no dumber idea in the world than maximizing shareholder value. You’ve gotta focus on employees, you’ve gotta focus on customers, you’ve gotta focus on the community. And that will indeed most likely maximize shareholder value over the long term.”

Tom Peters: But I will, based on the study that I did, and it was pretty extensive … Shareholder value maximization … Well, it’s interesting. The Harvard Business Review just had a major article by a guy who is older than I am … I’m 216 years old and I think he’s about 316 years old, and his name is Joe Bower, and he’s kind of the guru of gurus at Harvard and the Harvard strategy person and so on. And he said, “Wow, the business schools went totally off the track when they started focusing on the shareholder value maximization.” And he just throws the worst kind of hand grenades at his own school, the Harvard Business School. Giving shareholders great returns is fabulous, but it is not required by law, and the best way to do it is to put people first.

Tom Peters: In the people section, one of the things that I say which is indirectly related to this is, the customer comes second. If you want to wow the customer, first you must wow the people who wow the customer. And I actually got that years ago from a guy by the name of Hal Rosenbluth, who ran a big travel services company, which he sold to American Express for a few billion dollars. And he actually wrote a fabulous book which was called The Customer Comes Second. And his point being, if you want the customer to … I call it, if you want the customer to come first, then the employee who serves the customer must come more first, to really abuse the English language.

Roger Dooley: I’ll just offer one other comment. I agree with you totally, and I think that if you look at true maximization of shareholder value, it comes from acting, say, like Jeff Bezos does at Amazon, where he’s not worried about what this quarter looks like. He’s got his eye on the long game, and in doing so, he may not have initially created much shareholder value, but now he’s got one of the most valuable companies on the planet.

Roger Dooley: But it seems like people who aren’t in the position of Bezos or Zuckerberg, or they’ve either been given a license by their shareholders or they have enough control that they don’t have to be quite as responsive, is … The CEOs who don’t focus on that can get punished. The board fires them, or people like them come in, buy up a bunch of shares, and then somehow force them to adopt more shareholder-friendly strategies like paying out big dividends. Even Apple had that happen, and they’re certainly a wildly successful company.

Roger Dooley: So is there a way of dealing with that, or is it just a matter of trying to convince boards to-

Tom Peters: It’s interesting. The answer is, there’s no obviously easy solution. But I remember I spoke to a publicly traded, $10 billion plus electronic components company a couple of years ago, and I had just read this shareholder value myth, and I was talking to the CEO. And he said, “Boy, right on the money.” He said, “I tell my board of directors, if you want me to increase share price by 50% over the next 18 months, I can do it with both hands tied behind my back.” He said, “The problem is, I will destroy the long-term prospects of the company in the process, and as a result, if you ask me to do it, you will get my resignation letter within about 15 seconds.” And so he just laid down the law.

Tom Peters: And my smart aleck response would be, if you get fired for doing the right things, God bless you. The best thing that even happened to you was that you did get fired. I don’t have any … The Excellence Dividend is written in the context of the change driven by technology which we face. And I strongly believe that business has an incredible moral responsibility to the community at large. And if you don’t understand that as a leader, a first-line boss in a company, the equivalent of the Army sergeant, or as a CEO, I don’t want to see you, I don’t want to talk with you.

Tom Peters: I was at McKinsey. I have incredible respect for McKinsey. The guy who ran Valiant, the pharmaceutical company that went into the tank and was not convicted but was accused of the worst kind of misbehavior, the guy was a McKinsey alumni. And I hope it’s not true, but he was, it was said, part of a practice, maybe informal, at McKinsey, that was called “buy and cut”. And “buy and cut”, I think, is the most obscene three-word phrase, perhaps, in the English language.

Tom Peters: And it’s just what I was saying with the guy I talked to in the electronics company. I buy your damn company. I load you up with debt. I get rid of 25,000 people. I am guaranteed to have higher margins and higher profits over the next 36 months. I cash out at the end of 36 months. The company’s heart has been ripped out from it, and I watch it go down the tubes after I leave. And that’s a 30 years to life penalty, as far as I’m concerned.

Tom Peters: You’ve gotta live with yourself. You’ve gotta live with yourself at the end of the day. I’ve said to many people, I am not quite 200 years old, but I am over 70, and I said, “I only have one test. And my test is, can I walk past a mirror without barfing?” And if I felt my contribution was to have laid off 60,000 people, taken on a load of debt, and maximized shareholder value, I would shoot myself. And I said in the tweet, I think it was yesterday, I hope that CEOs pursuing shareholder value maximization as goal one, two, and three, roast in hell. And I’m serious about it.

Roger Dooley: Acronyms. There are probably more acronyms per square inch of page in The Excellence Dividend than any other book I’ve read. You need a glossary of acronyms, I think, particularly since a lot of them are completely unpronounceable. They’re a set of consonants that look like maybe a village in the former Soviet Republic of Kyrgyzstan.

Tom Peters: I think I may know the one you’re referring to in particular.

Roger Dooley: Well, one of them that did hit home was BSBM, Blatant Subconscious Behavior Manipulation. Now that something that our listeners are probably moderately familiar with, although they may not call it that. What I’m seeing is an increase in really senior level behavioral scientists in big companies. In other words, relatively high levels of visibility, not just somebody stuck down in a division somewhere.

Roger Dooley: In fact, a past guest on this show was Om Marwah, who’s head of the global behavioral science team at Walmart/Sam’s Club. And I’m curious just to hear your take. Is this a good thing or a bad thing? Obviously, if you can get more people to sign up for the 401(k) plan, that’s generally a good thing for the individual and for society. And if you use some behavioral science to do that, so much the better. But on the other hand, some people view it as manipulative. Are you seeing the same kind of thing that I’m seeing, or am I just kind of more aware of it and exposed to it?

Tom Peters: Oh, no, I think … Totally. One of the books that I cite several times is a book that I loved, and the woman who wrote it, Cathy O’Neil, was on Wall Street. She is an analyst’s analyst, she actually has a math PhD from Harvard. And the book, among other things, has one of the world’s best titles. And the title is Weapons of Math Destruction.

Tom Peters: And my problem, Roger, is people who should know better being dewy-eyed about this stuff, because I agree with you. The behavioral sciences, applied appropriately, can get more people to sign up for their 401(k)s. There’s no question about that whatsoever. And if you put the salads in front of the potato chips, kids may be kids, but statistically speaking, you’ll get more salad picked up at the school cafeteria than potato chips, at least relative to the past.

Tom Peters: But you just can’t kid yourself. You’re messing with people. I was appalled. I went to some McKinsey alumni meeting in Boston a couple years ago, and there was a marketing professor, and he went off on this big data thing. And he is absolutely right, you can learn a lot more and respond a lot. But he didn’t, as far as I was concerned, he had the moral compass of a seven-year-old. And he just didn’t acknowledge … It’s the same thing with the genetic engineering.

Tom Peters: There’s this new genetic engineering called CRISPR that allows you, in a high school chemistry kit, perhaps, to build a bug that could destroy the world. And there’s a wonderful book that came out by a woman who was one of the scientists who co-invented CRISPR, and the book is called A Crack in Creation. And in the first three or four chapters, she goes through this incredibly exciting, one day at a time, life in the lab when they found this. And then, and excuse the language which I’m going to use, she had a “holy shit” moment, and said, “What have we invented here?” And so the last three or four chapters of the book are about what could go wrong.

Tom Peters: And so I acknowledge the power, but just as Facebook and Mr. Zuckerberg have learned that a lot can go wrong when you’re naïve about this stuff, I am appalled by the level of naivete, and don’t want to be in a room with somebody who has really drunk the entire bucket of Kool Aid.

Tom Peters: Maybe this is the best way for me to say it. There was a book that came out recently written by somebody who knew their stuff, and it is called War in 140 Characters. And it begins with a little example from someplace in the Ukraine where, using the sort of data manipulation that may well have been applied to us by the Russians in 2016, basically groups are made divisive to the point that you get a micro, small scale civil war. And what this guy says … And everybody ought to have this in their head, and I’m not quoting him exactly right, it’s not in my book because I didn’t read it until after the book was already finished, is he says … Basically, he said the new ability to manipulate data is a stronger weapon than a nuclear bomb. Think about that. And everybody, I hope, who is listening to this, will go out and buy that book. War in 140 Characters.

Tom Peters: The advanced algorithmic manipulation is not a toy. And I think he’s right. If you can start a civil war to some extent with appropriate data manipulation and bringing people to the point where the hatred develops in a short period of time at a level that it hasn’t in the past, it’s not a gentle science. And I would underscore that in fact, my training, when I got my PhD at Stanford, was by one of the ultimate … I call it, behavioral science, I call it rat psychologist. I always say to people, I was trained by a rat psychologist. But my thesis advisor got his PhD in psychological statistics from the University of Chicago at the age of 20. So I had a no-screw-around advisor on this kind of stuff. So I’m not coming at it from the preacher’s pulpit of the local Methodist church. I’m coming at it from the basement of people who really know their stuff.

Tom Peters: I could not write algorithms for Google. I assure you I have not kept up in any way, shape, or form. The last language that I programmed in was probably FORTRAN, but that’s my dirty little secret. And hopefully you’ll cut that from the tape. I’m only kidding.

Roger Dooley: Well, Tom, I think your mirror test applies there too, whether you’re a data scientist or a behavioral scientist or even a CEO who’s in charge of these activities … If there’s something you’re not sure about, give it your mirror test. And do you still feel good about yourself if-

Tom Peters: Absolutely. And there’s another point. I remember I endorsed a book and they didn’t print my endorsement, which I wouldn’t have either. And it had to do with this stuff, and one of the things I said in my endorsement, though I did say something fundamentally nice about the book, I said, “Given the sophistication of behavioral manipulation, forewarned is not forearmed.” The level of sophistication is just that, the fact that I know it’s happening to me doesn’t really mean that I understand it or the extent of the manipulation that is or could take place.

Roger Dooley: And there’s actually research that shows that to be true too, that people are … Even when they’re made aware of a cognitive bias, they are still affected by it. So it’s definitely an appropriate quote, although maybe not the best way to sell copies of the book.

Tom Peters: Yeah, yeah. No, I totally … And I also told the editor, I said, “I usually say take my blurb and edit it any way you want.” But I said, “In this case, you’re not allowed to touch it.” I must say, when you were talking about cognitive biases, that was another lucky thing. The timing of my PhD was when Daniel Kahneman and Amos Tversky were starting their incredible research programs at Tel Aviv University, and of course Kahneman won the Nobel a few years ago, and if Mr. Tversky had not passed away, it would’ve been a shared Nobel. And I really do think that Thinking, Fast and Slow is a book … And it’s so well-written that you do not have to have a math background to understand it.

Tom Peters: But the other thing, incidentally, which you might be amused by … I think I may have put it in the book. If you go to Wikipedia and type in “cognitive biases”, you get a list that admittedly, as you well know or know better than I, there’s some duplication. But the top 155 cognitive biases. And I laughed hysterically when I read it.

Roger Dooley: Yeah, it’s expanded. A couple years ago, it was 67. And apparently somebody got really aggressive about adding to it.

Tom Peters: Absolutely. Yeah, it’s pretty darned extreme, but it does make a point.

Roger Dooley: Definitely.

Tom Peters: And the way I like to say it is, you go through your adult life, and if you think you ever open your mouth and make an unbiased comment, you are crazy and you don’t understand the literature.

Roger Dooley: Right. Tom, I want to respect your time, so let me remind our listeners that our guest today is Tom Peters, bestselling author. And in a world where everyone is a thought leader, someone who has actually earned the title. Tom’s latest book is The Excellence Dividend, and whether you’re an entrepreneur with a small business or a Fortune 50 executive, you’ll find tremendous value in it.

Roger Dooley: Tom, how can people find you and your ideas online?

Tom Peters: Well, you can go to tompeters.com, which has now been around for … Oh, I think I remember my first post was … When was it? I think it was 2004. So I’ve been blogging now for just about 15 years, and of course on Twitter as well, and you gave the handle @Tom_Peters. We are in all the usual places in terms of buying the book, Amazon and many, many, many others, including your local independent bookstores, and there are still a few of those left.

Tom Peters: But among other things, I’ve given 3,000 presentations and probably given 700 in the last 10-15 years. I do use PowerPoint slides, and you will find the presentation slides for every presentation that I have given at tompeters.com. And another place to go which we did is called excellencenow.com, and among other things there, you will find a 4,000 slide presentation of everything, which includes somewhere in the neighborhood of 250,000 words worth of annotation. So you can get a lot more than you bargained for between tompeters.com and excellencenow.com. But everything is free, and my only primary goal in life is to be stolen from.

Roger Dooley: Great. Well, we will link to those places, and all of the many other resources we talked about on the show notes page at rogerdooley.com/podcast. Tom, it’s been an honor to have you on the show.

Tom Peters: Hey Roger, it has been great fun, and thank you for the kind words today and kind words at Twitter, and they are deeply appreciated, I assure you.

Roger Dooley: Well, and totally deserved. Thanks, Tom.

Roger Dooley: Thank you for joining me for this episode of the Brainfluence podcast. To continue the discussion and to find your own path to brainy success, please visit us at rogerdooley.com.